Selling to Italy: A Rising Ecommerce Opportunity with a Limited Local Market

Italy has been put under a lot of scrutiny by financial markets due to high unemployment, and high public debt. However, even in the face of all these challenges, the ecommerce market in Italy is booming and may even surpass the European leaders in the coming years.

Italians show a big interest in buying from online sellers from abroad. This is mainly due to the relatively limited availability of some products on the local market and relatively low competitiveness among domestic ecommerce merchants. This situation presents great opportunities for international sellers.

Main characteristics of the Italian marketplace and consumers

Italy is the second largest ecommerce market in Southern Europe, with a turnover of almost €17 billion (2015). Forbes lists Italy as the No. 42 Best Country for Business and No. 28 in terms of Ease of Doing Business.

Even in the face of the financial crises that have affected Southern European countries, ecommerce in Italy has been experiencing steady growth in the last few years and the positive trend is expected to continue. Currently, Internet penetration in Italy is much lower compared to European leaders.

Bear in mind that over 90% of the population speaks Italian (also spoken in a few other countries, such as Switzerland and Malta).

Make sure to offer your Italian customers the possibility to shop for your products in a localized online store or marketplace.

Italian ecommerce market in numbers

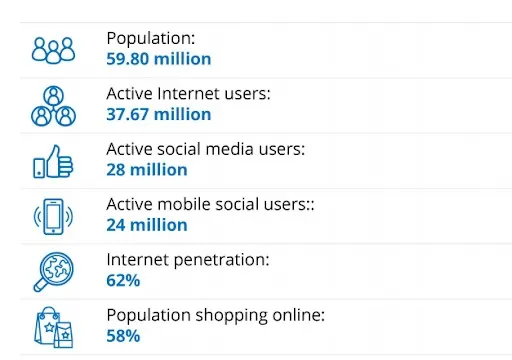

59.80 million – Population

62% – Internet penetration

58% – Population online shopping

45% – Population shopping online from abroad

When you target Italian online buyers, remember that most active users are aged 25-34.

Online buying behavior

Due to the challenging economic climate and an “anti-recession” reflex, Italians are interested in online purchases and attractive prices. Typically for less mature markets, there’s a preference for services over the purchasing of physical products online. However, the trend is beginning to reverse.

Italian ecommerce consumers can be known to have high expectations when buying and often expect outstanding customer service.

Italian online shoppers are relatively patient. In general, they’re ok to wait 3-5 days for their orders to arrive but expect free shipping or low shipping rates.

According to a study by ContentSquare, Italian Internet users can be indecisive. Before placing an order, they may want to visit a website at least five times. They also like wishlists and often use the add to basket function to add items to their wishlists to review at a later date. Thus, it’s recommended that your site has a wishlist function.

In terms of return rates for ecommerce sales in Italy, it’s 5% for general goods, 15% for electronics and over 40% for fashion. It’s crucial to offer easy returns solutions.

Popular product categories

Among top products purchased by Italian online buyers are home electronics, clothing/footwear, and books.

And what do Italians like to purchase from abroad?

Vehicle Parts and Accessories

Clothes, Shoes, and Accessories

Home and Garden

Computers, Tablets, and Networking

Logistics, delivery, and shipping

According to DPD, the top delivery method in Italy is home/office delivery, followed by delivery to an alternative address. The main parcel carriers include Poste Italiane Group, GLS Italy, DHL, UPS, TNT Express and FedEx. B2C delivery is dominated by Poste Italiane and BRT (formerly Bartolini).

When it comes to the general experience of Italian consumers with domestic postal services, it hasn’t been particularly positive due to relatively slow and at times unreliable services.

However, consumer delivery expectations and demands are rising. This results in the expansion of the range of delivery options available to online buyers, e.g. lockers and collection/return points.

Keep in mind the fact that the Italian shoppers don’t like being surprised by unexpected costs. They like transparency and want to see delivery rates early on in the online buying experience. They also appreciate multiple delivery options.

To meet the demands of Italian online buyers in terms of delivery, offer competitive shipping rates/free delivery and ensure easy returns solutions. Italian consumers are also happy to be able to choose the delivery location and know the delivery day and time at the time of purchase.

Almost 100% of Italian consumers would be happy to have the ability to track their purchase.

Over half of Italian customers are more likely to shop from an online retailer if they have a possibility to collect the item in-store. Collecting an item at a pick-up location is an attractive option as it’s cheaper.

The local postal network Poste Italiane lags behind its peers and some delays can be expected. Thus, we recommend using parcel services, such as Bartolini or DHL, to minimize the risk of bad shipping experience. There’s a difference in delivery times and shipping experience between the North, the South, and the islands.

If the cart system doesn’t allow for the creation of delivery zones, e.g. mainland Italy vs. Sicily, consider adding 1-2 days to the promised delivery time at the check-out in case of relevant regions. This way sellers can set the right delivery expectations. They can also minimize frustrating experiences caused by potential delays typical for specific locations in Italy.

Payment methods

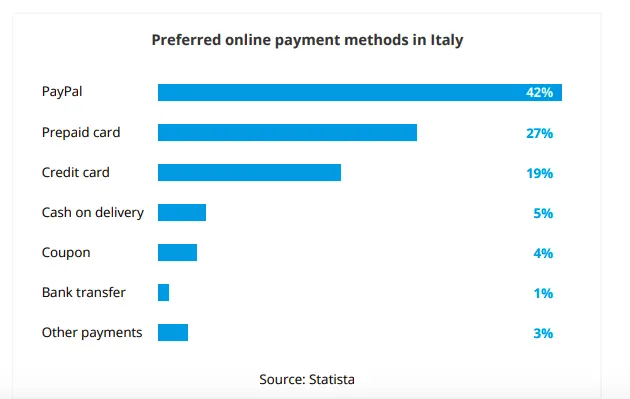

Italians’ favorite payment methods are Paypal, followed by prepaid and credit cards and cash on delivery. Italian buyers like having the possibility of the direct bank or post-transfer (bonifico bancario). If sellers fail to provide this payment method, they run the risk of many abandoned shopping carts.

Unlike other European countries, Italy seems to be relatively cash-reliant. Security is an issue for many Italians when making online payments, which may be a bit challenging for online sellers.

Mobile ecommerce

The mobile share of retail ecommerce sales in Italy amounts to 30%, which is behind the mobile ecommerce leaders in Europe, such as the UK (52%) or the Netherlands (39%).

87% of Italian online buyers purchase via desktop, which contrasts with the smartphone (7%) and tablet (3%) shoppers. Internet penetration is expected to increase and reach 70.9% by 2022.

Cross-border shopping

Ecommerce consumers in Italy like to buy products cross-border due to the relatively limited availability of Italian products. There’s a high demand for products not really offered on the domestic marketplace, e.g. clothes from foreign brands or vehicle parts for cars imported from abroad. The favorite online shopping destinations of Italians include the UK, the US, and China.

Cross-border ecommerce is gaining more and more significance in Italy. Over a quarter of French online retailers sell in Italy and a third of Italian consumers have made a purchase from a foreign website.

Benefits and challenges of selling to Italy

Benefits

First, Italy belongs to leading ecommerce markets in Southern Europe and some sources quote Italy as one of the fastest growing markets in Western Europe.

Second, you can expect less competition in Italy than in the top ecommerce marketplaces, such as Germany or the UK. It’s estimated that 20% of online shops generate 70% of Italy’s ecommerce sales revenue. In top ecommerce countries it’s usually difficult to stand out from the competition, but in less mature markets, buyers are hungry to see more product offerings and more choice.

Third, Italy is going digital and smartphone shopping is on the increase. This shift in the mindset of the Italian consumer has a positive impact on ecommerce sales volume.

Fourth, Italy is full of bargain-driven online shoppers. However, due to the difficult economic situation, there’s been a lack of dynamism in the local offering and the availability of some products is limited on the domestic market.

Italians are keen on online shopping, but domestic brands tend to struggle to keep up with the pace of demand. This is where online sellers from abroad can come to the rescue of Italian shoppers, making some good sales deals for themselves, too.

Challenges

First, economic instability has given Italy some hard times and bad PR. Ecommerce has also lagged behind, mainly due to the high level of credit card fraud, lack of trust in the postal system and the less favorable return policies of Italian sellers.

Second, a marked contrast between the more prosperous northern and the less developed southern regions of Italy makes it necessary to adjust selling strategies accordingly.

Third, Italians are open for cross-border purchases, but they’re still rather hesitant about having to pay extra costs, such as delivery fees. As it can be a serious barrier to purchase, you should try to reduce such costs as much as you can. Using parcel forwarding services will allow you to offer competitive shipping rates.

Fourth, since Italian is spoken by over 90% of the local population, some sellers can see the language barrier as an obstacle. Luckily, there’s a good solution for international online sellers: Offering a localized buying experience.

Summary

International development is one of the trends driving ecommerce in Italy. Despite a few problems related to economic growth, the ecommerce market in Italy is thriving and there are gaps to be exploited by international online sellers.

There’s a high demand for products purchased online, especially those barely offered by local sellers or not offered at all, e.g. clothes from foreign brands or vehicle parts for cars imported from abroad.

Thus, do some research and once you’ve identified opportunities for your online store on the Italian marketplace, win the local buyer by offering them a localized buying experience!

Karolina Kulach is a content marketer at Webinterpret and non-fiction writer, specializing in global ecommerce. Educated in Linguistics (MA) and Business Studies (BA Hons). A well-traveled individual with international education & work experience gained in London, Scotland, Poland and Germany. In her spare time buzzing with creative content ideas, including rhyming poems.