Watch Our Product Tour

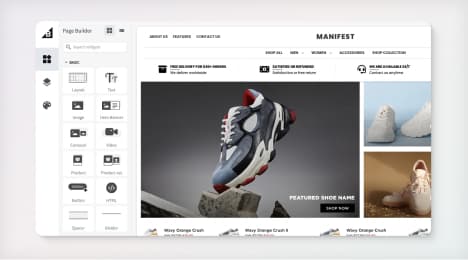

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

How to register a business

Registering a business is an important step to ensure that your new ecommerce venture complies with local and state laws on taxes, operation and naming. Registration you'll be legally operating as a legitimate entity, creating a strong foundation to grow a successful ecommerce business.

Registering a business doesn't have to be complicated. Here's a step-by-step guide to help you get started.

1. Decide on a business structure

A prospective business owner or group of owners can choose from a variety of different structures. The most common for ecommerce businesses are a sole proprietorship, a partnership and a limited liability company, also known as an LLC. These structures have differences related to how taxes are calculated and paid, as well as concerns such as profit-sharing and liability with business partners. The U.S. Small Business Administration provides a detailed breakdown of all business types and their unique advantages and disadvantages, on its website (1).

2. Register the business name

A good, interesting or unique name is a crucial part of developing a brand for an ecommerce business. Legally, any business name other than the given name of the owner has to be registered with local authorities (2). LLCs and corporations include the name selection as part of the overall paperwork. Sole proprietorships and partnerships need to file a specific form with their local government to register a name; otherwise it defaults to the name of the owner or owners.

This assumed business name is often called the "doing business as" or DBA name. The legal name is needed for tax paperwork, licenses, permits and other government forms. The vast majority of states require the registration of a DBA name, although there are a few exceptions. The SBA (Small Business Administration) offers an exhaustive list of the correct agencies to contact on its website (3).

3. Get a federal tax ID number

Sole proprietorships with no employees don't need a federal tax ID number from the IRS, but corporations, LLCs and partnerships do. The federal tax ID number designates a business, and is useful for keeping personal and business taxes and finances separate. The IRS allows businesses to apply for an ID number, also known as an employer identification number or EIN, through a website portal (4). The EIN is generated instantly as long as there are no issues with the information provided.

4. Register with the state tax authorities

After federal obligations are taken care of, the next step is to register with state tax authorities. There are tax obligations on the state and local levels for the vast majority of ecommerce businesses. New ventures need to register with their state's revenue office, and in some states may also have to apply for a permit to collect sales tax.

5. Get any operating licenses and permits

While your ecommerce business won't be conducting sales from a storefront, home or other physical locations, there are still permits and licenses required by different municipalities and states. There are a wide array of different forms to fill out, government offices to contact and other obligations to consider, depending on where your business is located. You can call your town, city or county clerk's office to get on the right track with any permitting issues. The SBA also offers a tool to search for required licenses and permits (5).

1. "Choose Your Business Structure."

2. "Register Your Business Name."

3. "Register with State Agencies."

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo