Watch Our Product Tour

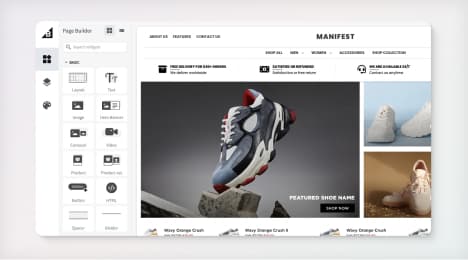

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is Debt-to-Equity Ratio?

As a business owner or manager, you have to wear a lot of hats. One day you may be deciding on the best VoIP phone for the office and the next, making critical hiring choices. What’s more, you need a better than passing knowledge of all kinds of business areas.

That often includes understanding the complexities of corporate finance. Doing so is no straightforward task. If your background isn’t in finance, even the terminology used can feel baffling. Do you know, for instance, what debt-to-equity ratio is? Do you know how to calculate it or what it can tell you about your business?

If you answered no to any or all of the above questions, never fear. All you have to do is to read on, and you’ll learn everything you need to know.

Defining Debt-to-Equity Ratio

The debt-to-equity ratio (also written as D/E ratio) is a comparatively simple statistical measure. It’s a staple of corporate finance and assesses how effectively a firm can cover its existing debt.

The higher the D/E ratio, the more a company is funding operations by accruing debts. The more difficult it would be, therefore, to cover liabilities if the firm ran into trouble.

If a D/E ratio is lower, the business in question funds operations more through owned assets. That means if the company runs into difficulties, it would more easily pay off what it owes. The ratio, therefore, is an essential measure of a firm’s health and financial leverage.

Calculating Your D/E Ratio

Fortunately, you don’t need to be an accountancy expert to work out your D/E ratio. All you need is access to your balance sheet, to know what to look for, and to understand what to do with it. We’ve got you covered for the latter two requirements.

1. The formula.

You calculate your debt-to-equity ratio by first working out your total liabilities. Then, you add up the firm’s total shareholder equity and divide the former by the latter. The formula to find out your D/E ratio, therefore, looks like this:

D/E RATIO = (TOTAL LIABILITIES / TOTAL SHAREHOLDER EQUITY)

Say, for instance, you have liabilities totaling $4 million. Then, you find that your shareholder equity equals $2 million. Your D/E calculation would be as follows:

($4 million / $2 million) = 2

Your D/E is two, which can also be expressed as 200%. That means your debts are worth two-times the amount of your total equity.

2. What constitutes debts & equity?

Now you’ve got the formula, all you need to know is what makes up your debts and equity to include within it. The debts include both short term and long term liabilities. That means things like long term leases and accounts payable for digital ad spend and more.

When it comes to shareholder equity, it’s more straightforward. Your balance sheet should record this figure. It’s the total value of the company, according to the stock owned by shareholders.

What Your D/E Ratio Tells You

Why, though, is it useful to calculate your D/E ratio? You’re not an accountant, after all. Well, the value of this ratio is found in what it tells you about your financial health. Notably, the measure reveals how resilient your firm will be if times get harder.

Say you find you have a high D/E ratio, for example. That reveals you could struggle to cover your liabilities if revenue falls. Meanwhile, a lower figure could show you’re not leveraging your assets as effectively as you might.

Such insights put other decisions into a whole new light. You’re far better placed to weigh up warehouse management system benefits against costs, for instance. If you’ve got a low D/E ratio, you know the extra outlay for a new setup is within your compass.

Conclusion

So, there you go. You now know all you need about debt-to-equity ratio. You may well wish you’d just focussed on your decision about a small business phone service! The world of corporate finance, after all, is a little dry.

A good grounding in such things, though, will stand you in good stead. By understanding D/E ratio and calculating your own, you can learn far more about your firm’s health and future viability.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo