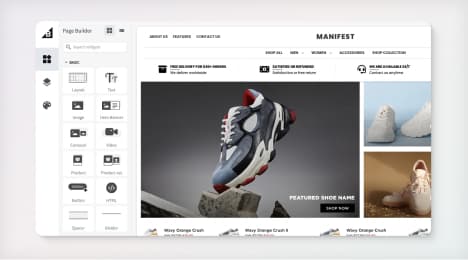

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What tax breaks are available for small-business owners?

The April 15 deadline for filing federal and state tax returns is always fast approaching for small businesses. To make matters worse, the tax code may seem like an impenetrable web of regulations that requires a master's degree in federal finance law to understand.

As a small-business owner, your priority is to keep existing customers happy and loyal, while also working on ways to improve acquisition. But this time of year brings the added stress of ensuring your return doesn't have any missing or inaccurate information that will get you in trouble with the IRS. However, it's important to keep in mind that the federal government is generally in support of small-business owners, and wants to give them as many opportunities to remain viable as possible. As a result, small-business owners have access to more tax breaks than they may know offhand.

Keeping as much money within a small-business owner's coffers by taking advantage of all available tax breaks helps ensure there's cash on hand. But what credits and deductions are available specifically for small businesses to leverage on their filings? Here are several breaks that you should know about:

Capital expenses can be deducted or amortized when you file your taxes.

Getting off the ground

Businesses of any size must get started at some level. Considering most organizations start out small and then eventually grow, the tax code has been written to help small businesses keep their legs underneath themselves. Accordingly, capital expenses - or the financial investments you make get your business off the ground - can be deducted or amortized when you file your taxes. For instance, if the product your business makes required research and experimentation to bring it to market, you can deduct the costs from the first year you pay for them. Or you can amortize the cost over 60 months, meaning you pay over an extended period time, which is useful if you're also making a profit from the product of the research.

Making the most of the home office environment

Depending on the type of company that a small-business owner operates, he or she may very well be able to deduct the expenses related to setting up a home office. However, a room with a computer doesn't automatically qualify you for the tax breaks. In order to get the deduction, you're responsible for demonstrating to the IRS that you use your home as the principal place of business.

The actual amount that you can deduct are based on the percentage of the entire structure of the home that the home office takes up. As a result, the small-business owner who works in their place of residence must get out the measuring tape to calculate the square footage of the space used as the principal place of business. After you've done so, you divide this amount by the total square footage of the home, the method used to deduct expenses such as mortgage, rent, electricity and other costs.

However, the deductions don't end there. Small-business owners are also able to get a tax break for expenditures, including office supplies and furniture. The latter falls under Section 179 of the tax code, which is critical portion and is worth reading for small business owners.

Property deductions

Section 179 property may not be applicable to all small-business owners, but it's still an excellent way to reduce the amount of taxes owed to the government.Small businesses can deduct up to $500,000 for property used in manufacturing and transportation. In addition, any facility used for business, research, storage for horticultural products or housing for livestock. Even computer software qualifies under this section of the tax code. As long as these items and buildings were expenses during the first year of use, you're able to deduct the cost.

However, certain types of property don't qualify. These include land, facilities used to hold air conditioning or heating equipment and buildings used to lodge individuals.

Not all types of property can be deducted from your taxes.

Operating costs

There are very few small businesses that can function without staff, but even these people who you pay to fulfill a necessary role can be tax deductible. The only catch is that you have to pay them in cash, property or service. Furthermore, health care place and life insurance provided to your staff is expensive, but in most cases can be written off on your taxes.

In addition, any small organizations that manufacture a product can get a tax break for every item sold. Without marketing your business, it can be difficult to make headway in a competitive marketplace, which is why small business owners can also deduct the cost of advertising, such as business cards and even sponsorships.

Although there are many more tax breaks available to small business owners, these are a few of the most common and important to keep the cash flow liquid.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo