About the App

International selling and compliance made easy!

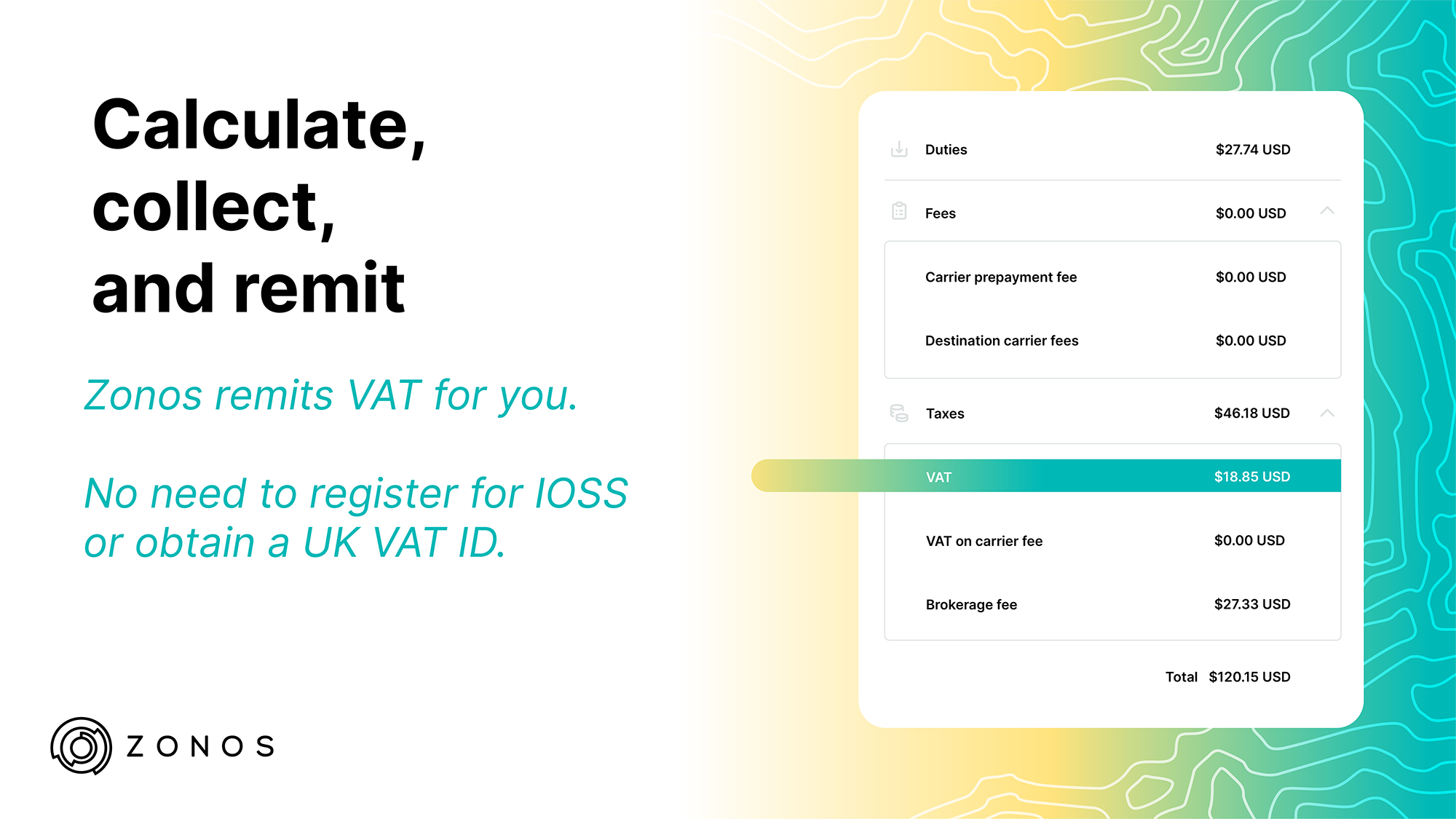

Calculate, collect, and remit duties, taxes, and fees on all cross-border orders

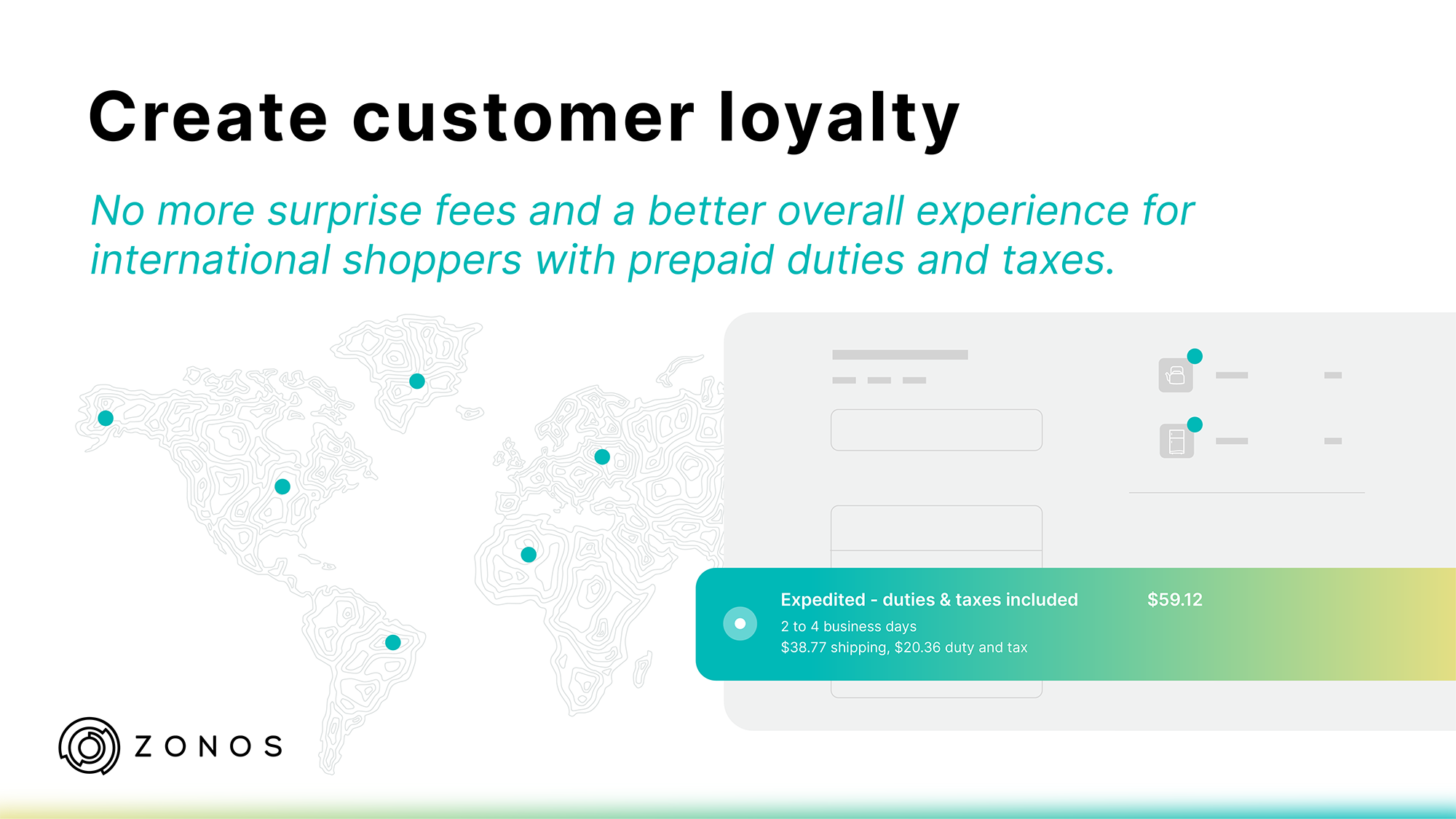

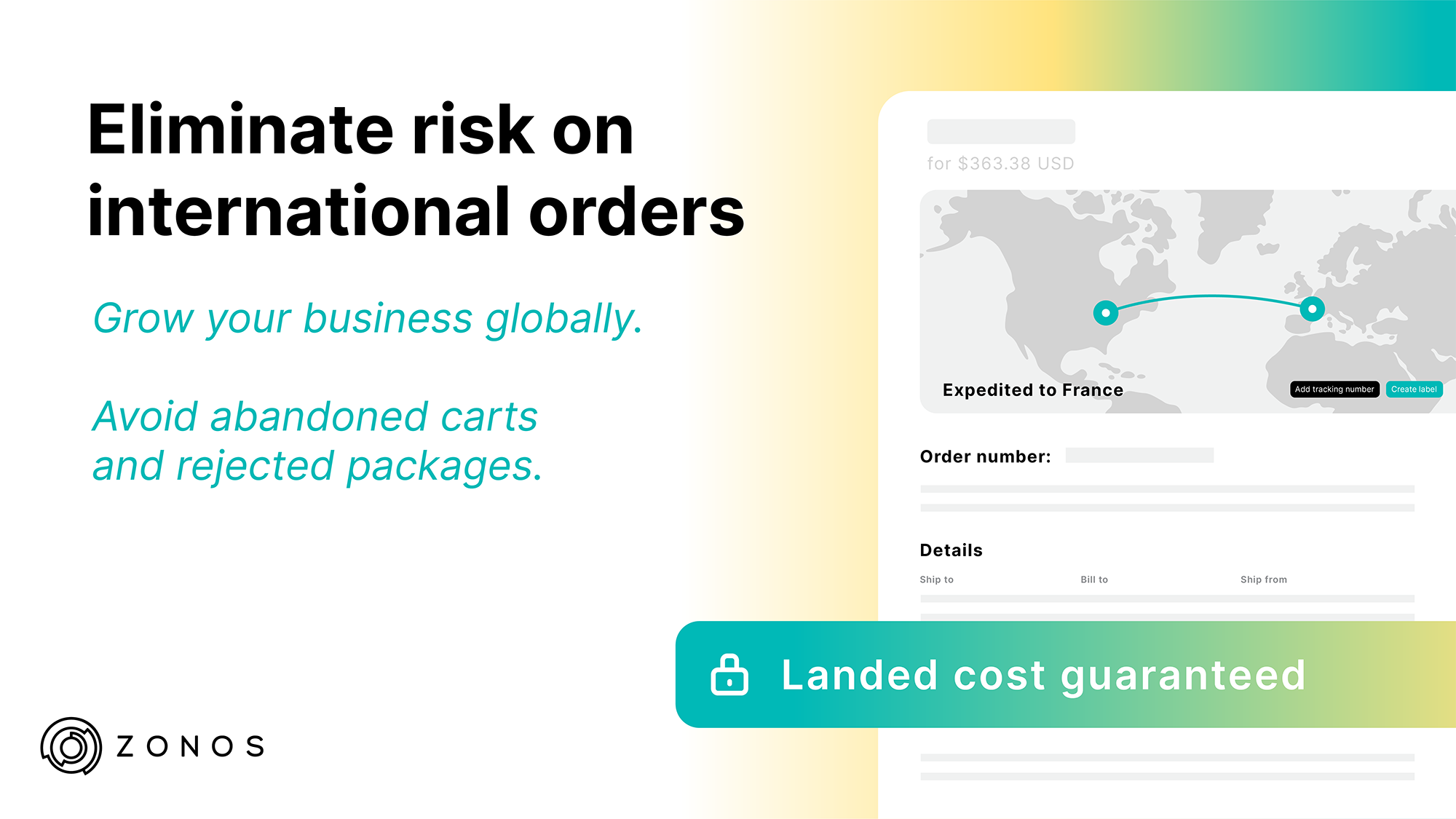

Grow your business globally while avoiding abandoned carts and rejected packages. Offer international shoppers a better experience by letting them pay duties, taxes, and fees up front, giving them cost transparency and faster customs clearance. Zonos makes cross-border selling easy with automated cross-border tax compliance, including guaranteed landed cost calculations, duty/tax collection, VAT threshold monitoring, in-country tax registration/remittance (UK VAT, IOSS, etc), and reconciliation.

Includes:

Calculate and collect duties, taxes, and fees from international shoppers

Zonos pays the duty and tax bill — No need to reconcile or dispute carrier bills

VAT scheme threshold monitoring — You only collect when you need to

Zonos remits VAT for you — No need to register for IOSS or obtain a UK VAT ID

Connect your own carrier accounts for complete control of your shipping rates

Carrier import fee discounts — Up to 50% off advancement fees (UPS, DHL, FedEx)

Includes 10,000 HS code product classifications - yearly, to help you stay compliant

Easily create compliant cross-border labels with pre-filled customs paperwork

Zonos Hello welcomes international shoppers to your website in their default language

Localized messaging informs international shoppers of important customs information, duty rates, etc., to build trust and increase conversion

Note: Works with Stencil themes, not available for Blueprint.

Pricing

Custom Pricing:

$250/mo or $2,400/yr (20% off) + setup fee. $2 + 10% of the duties, taxes, and fees added to the landed cost, paid for by the shopper.

Information

Last Updated:

April 17, 2024

This app may not be fully compatible with multi-storefront. Please get in touch with the technical partner for further details.

Documentation:

Installation GuideUser GuidePricing

Custom Pricing:

$250/mo or $2,400/yr (20% off) + setup fee. $2 + 10% of the duties, taxes, and fees added to the landed cost, paid for by the shopper.

Information

Last Updated:

April 17, 2024

This app may not be fully compatible with multi-storefront. Please get in touch with the technical partner for further details.

Documentation:

Installation GuideUser GuideApp Features

Up-front landed cost calculations = faster delivery and happy customers

Providing international customers with an accurate total landed cost is essential for growing your business globally. The Zonos Duty & Tax app shows the total cost upfront, including any duties, taxes, brokerage fees, and other expenses, helping prevent abandoned carts and rejected packages. In addition, customers can prepay for duties and taxes for faster customs clearance and delivery times. Zonos also welcomes international shoppers in their language, increasing transparency, conversion, and sales.

Easy cross-border tax compliance management - including UK VAT and IOSS

Easy international tax compliance is essential for businesses that want to sell globally but do not want the accompanying stress and headache. With Zonos, you can stay compliant with country-specific tax schemes, such as UK VAT and IOSS, without having to register for international tax IDs or remit yourself. Zonos monitors VAT scheme thresholds for you, collects duty and tax when required, pays your duty and tax bill and remits to the appropriate countries saving you the time and hassle of reconciling or disputing duty and tax invoices. With compliance easily handled, you can focus on growing your business!

Shipping rate calculation and carrier management

With Zonos, manage your shipping rates easily and customize them to fit your business. We support a wide range of express carriers, postal carriers, and more. You have complete control over your shipping rates, including uploading your custom rate charts and offering flat rates by country, weight, or price. We also integrate directly with your shipping account(s) and support API integrations with UPS, FedEx, DHL, USPS, and more. Additionally, enjoy discounted carrier import fees and unlimited custom shipping rules, and easily print compliant cross-border labels with pre-filled customs paperwork.

Zonos' world-class support and accuracy make it the best option for cross-border selling

Over ten years of experience and a proven track record of providing accurate and reliable landed cost calculations make Zonos the best choice for cross-border selling. Our world-class support and onboarding teams provide dedicated support, priority email, and phone support to ensure your success. We help retailers grow their businesses globally while avoiding the usual pitfalls and ensuring a seamless and transparent checkout process for their customers.

Includes Zonos Hello localized messaging

Hello welcomes cross-border shoppers to your website in their language letting them know you can accommodate them and gives them important customs information. Optional* - estimate duties and taxes as they add items to their cart.

Case Studies

500 percent international growth, customer satisfaction booms with Zonos

With Special Reserve Games' (SRG) massive following for their collectible video game art releases, they are no stranger to international selling and the pitfalls that come with it. Navigating the complexities of cross-border selling, such as trade laws, duty and tax calculations, and customer complaints, was starting to become a nightmare for SRG.

They found the Zonos Duty & Tax app for BigCommerce, enabling SRG to calculate landed costs and allow customers to prepay duties, taxes, and fees in their localized currency, all of which saved SRG money and eliminated international customer complaints.

Customers who installed this app also installed

There are no slides

Build your online store with BigCommerce

Start your trial today