Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

Building Materials Distributors: Winning with BigCommerce in 2026

Written by

Samuel Palomares16/02/2026

Building Materials Distributors: Winning with BigCommerce in 2026

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

Key takeaways:

Demand is flat, but some distributors are still growing by taking share in construction material ecommerce.

Costs and pricing volatility are now permanent constraints, not temporary issues.

Buyers are already ordering online through ecommerce for construction materials, but many are frustrated with the experience.

Making it easier to buy through ecommerce for building supply matters more than expanding footprint or adding headcount.

BigCommerce is often evaluated when distributors outgrow basic construction ecommerce tools and need systems that match how their business actually runs.

Why is the building materials market splitting in 2026?

The building materials market is changing — whether you want it to or not.

Some distributors are pulling ahead, while others are getting squeezed. The difference isn’t luck. It’s how easy they make it for customers to buy from them.

Demand is flat. Costs aren’t. Buyers are changing how they purchase faster than many distributors are changing how they sell. In this market, operational execution matters more than long-term expansion plans.

According to our 2025 Industrial Buyer Report, online purchases represented just 4.3% of total contractor order volume in 2018. By 2025, that number reached 30% — a 702% increase. More telling, over 58% of purchases now happen outside traditional distributor relationships, reinforcing the importance of building materials ecommerce.

Going into 2026, the question is no longer whether ecommerce matters. The real question is whether your digital setup — including your ecommerce website for building materials — helps you win work or quietly sends customers elsewhere. Just as importantly, are you capturing the full construction ecommerce benefits your business expects?

How are leading distributors growing in a flat market?

According to Webb Analytics 2025 Construction Supply 150 report, the North American lumber and building materials market is roughly $620 billion, with U.S. dealers contributing about $600 billion of that total. In 2024, the top 150 construction supply dealers generated $412 billion in revenue, capturing more than two-thirds of the U.S. market.

At first glance, the market looks steady. Under the surface, it’s splitting.

In 2024, CS150 companies that expanded their footprint grew revenue by 1.6%. Those that didn’t saw revenue fall by 2.4%.

Looking ahead to 2026, the environment remains challenging:

Single-family starts will fall another 2–3%, with mortgage rates still above 6%.

Overall construction demand will stay mostly flat, with growth limited to data centres, infrastructure, and advanced manufacturing.

Contractor expectations entering 2026 remain cautious, a theme echoed across industry commentary from the Structural Building Components Association and LBM trade media.

Distributors who grow in this environment will not be lifted by the market. They will grow by taking share.

Ask yourself: if demand stays flat next year, what would actually make a customer choose you again?

Why aren't building material costs going back to normal?

After a brief period of stability, material costs are rising again. According to Gordian and reporting from Construction Dive, prices began increasing in the second half of 2025, driven mainly by copper, electrical components, and data centre construction. Forecasts call for another 2–4% increase in 2026.

The longer view makes the pattern clear. Material prices rose more than 40% above pre-pandemic levels and peaked in 2022 at roughly 46% above early-2020 pricing. Prices declined, but they never returned to prior levels. Now they are rising again.

According to Deloitte, tariffs add further uncertainty. Effective tariff rates on construction goods reached a 40-year high of roughly 25–30% in 2025. Contractors are responding by adding escalation clauses and purchasing early when possible.

When prices change frequently, customers need clear and current information. Without it, trust erodes and margins suffer in construction material ecommerce.

For example, if a contractor places an order online and the price changes later without warning, they remember it. If it happens twice, they start shopping elsewhere — especially if competitors are promoting switching incentives or offering threshold-based discounts to win heavy equipment aftermarket accounts.

Digital systems that keep pricing, surcharges, and lead times up to date are now basic business hygiene.

What do B2B buyers expect from online ordering in 2026?

Buying online is no longer unusual in B2B building materials and B2B construction materials environments. This is true across materials distribution, B2B commerce for construction machinery, and heavy equipment parts.

What stands out now is how frustrated many buyers are with the experience.

According to MDM's 2025 B2B buyer research, digital purchasing now dominates buyer behaviour:

67% make at least half of their purchases online.

83% expect online purchasing to increase.

45% report dissatisfaction with their current online experience.

Only 33% can reorder with one click.

In a business built on repeat orders, small delays add up.

If a contractor has to call or email just to reorder last week’s materials, they will eventually try a supplier that makes it easier — whether that’s a competing distributor or a B2B marketplace construction platform built for speed and simplicity.

What buyers now expect as standard:

Online bill pay.

Access to order history and invoice.

Real-time order tracking.

Basic account and user management.

What buyers increasingly require:

The ability to edit orders after they’re placed.

The ability to reschedule deliveries without calling a branch.

Tools to build quotes online.

Clear, agreed-upon pricing before an order is submitted.

These expectations raise the bar not just for ecommerce, but for digital marketing for building material suppliers who must promote speed, transparency, and self-service as part of their value proposition.

If a customer has to call you to handle any of the basics above, your competitors are quietly gaining an advantage. Industry groups like the Florida Building Material Association note that ecommerce is quickly becoming a requirement for distributor survival, not an optional upgrade.

How can ecommerce help sales teams sell more?

Most distributors still rely on customers to call or email when they need something. At the same time, 78% say proactive selling is important, yet few consistently act on it.

Leading distributors use ecommerce systems to spot inactive accounts, remind customers to reorder, and suggest related products before a salesperson ever picks up the phone.

When ecommerce only processes inbound orders, it limits growth. The real value is when it helps sales teams focus on the right conversations — not replace them.

Why do different building materials business models need different digital tools?

The building materials industry is not one-size-fits-all. What works for one distributor may not work for another.

Webb Analytics 2025 Construction Supply 150 report shows that distributors with value-added manufacturing declined about 2.1% in 2024, while lumberyards without manufacturing declined roughly 8.5%.

Ask yourself: does your digital setup support how you actually make money, or does it force you into a generic process?

Value-added businesses are harder to replace. Digital tools should protect that advantage, not water it down.

Why do building materials distributors choose BigCommerce?

Building materials distributors do not operate like online retailers. They manage contract pricing, multiple yards, quotes, credit terms, and customers who expect consistency from order to order.

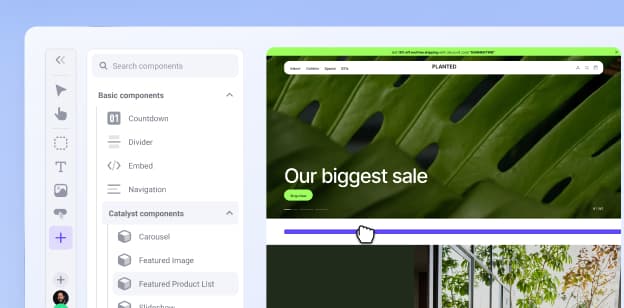

BigCommerce is built to support modern building materials ecommerce and complex ecommerce construction use cases:

Contract pricing by customer or account so your framing contractor sees their negotiated price, not a generic list, preserving the relationship economics that drive loyalty in building materials.

Inventory visibility across multiple locations answering the question buyers ask most often: do you have it, and where?

Orders that start as quotes and involve salespeople when needed — aligning with real-world B2B sales management construction ecommerce workflows.

Credit limits, payment terms, and purchase orders supporting the financial workflows your buyers already run internally.

B2B and B2C on one platform so distributors serving professional and retail customers do not need two separate systems or data environments.

Mobile-responsive design meeting buyers where they actually are: in the truck, at the counter, or on the job site.

This is why many distributors evaluate BigCommerce once they outgrow basic ecommerce tools and need a system that matches how their business actually runs.

No ecommerce platform replaces operational discipline, clean data, or clear rules. Digital systems make strong operations stronger and expose weak ones. The goal is not more features. It’s a digital foundation that works when business is strong and when it is not.

MKM BigCommerce case study.

MKM Building Supplies — the UK’s largest independent builders’ merchant — migrated to BigCommerce to modernise its B2B ecommerce experience. Within four weeks of launch, MKM saw a 42% increase in site traffic and an 82% increase in revenue, alongside a 75% improvement in average page load speed.

By aligning digital systems with how its branches and customers actually operate, MKM transformed its online store from a liability into a growth engine.

The final word

The building materials market may remain flat, but that does not mean your strategy should.

The next year will reward distributors who focus on execution, discipline, and making it easier for customers to do business. That starts with a few practical steps:

Track how many orders start online and compare that number to the roughly 30% industry average.

Try reordering as a customer. If it takes more than one click, you are at a disadvantage.

Use digital data to strengthen building materials B2B marketing and support sales teams, not just to process orders.

Invest first in systems that still matter when the market slows.

Make sure your digital approach matches how your business actually makes money.

The distributors who win in 2026 won’t be the ones waiting for conditions to improve. They will be the ones who make it easier for customers to buy, day after day, even when times are tough.

Explore how BigCommerce helps building materials distributors simplify complex B2B ecommerce — request a demo.