Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

How Tariffs Are Impacting Small Ecommerce Businesses (and What to Do About It)

Written by

Austin Comer

How Tariffs Are Impacting Small Ecommerce Businesses (and What to Do About It)

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

Tariffs are back in the headlines, and small ecommerce businesses are starting to feel the pressure. Whether you manufacture your products abroad, source components internationally, or sell across borders, recent changes in US trade policy — like new tariffs or adjustments to the de minimis exemption — could directly impact your profit margins, pricing strategy, and supply chain.

With global trade in flux and import duties on the rise, many small ecommerce businesses are wondering how to stay competitive without sacrificing their bottom line. In this blog, we’ll walk through what you should know, what actions you can take, and how to protect your business from potential fallout.

What are tariffs and why do they matter for ecommerce?

Tariffs are taxes imposed on goods imported from other countries. When tariffs go up, whether due to changes in US trade policy, retaliatory tariffs, or other international adjustments, so do the costs of those goods. For ecommerce brands, that can mean higher costs for finished products, components, or packaging. This affects online sellers using platforms like Shopify, BigCommerce, and Amazon, who may face tough decisions around pricing, sourcing, and customer communication. For customers, it can mean unexpected duties on imported goods (especially if duty-free thresholds change), higher prices, or assortment changes to their favorite products.

If you're selling online in competitive marketplaces like Amazon, or rely on global sourcing from countries like China or Mexico, those cost increases can be hard to absorb. Even companies focused on domestic manufacturing often source raw materials internationally and risk cost exposure from tariffs.

The real question becomes: how do you manage tariff impacts without losing your competitiveness, customers, or growth momentum?

How tariffs affect online retailers' supply chains

Not every small business will be impacted in the same way. If you manufacture, source, or sell products and raw materials overseas, you'll likely feel the effects of new tariffs or reciprocal tariffs directly. But even if you rely on fully domestic production (both raw materials and manufacturing), your competitors may be affected, giving you a short-term advantage. Knowing where your products and parts come from and how they interact with current trade policy is key.

Once you understand the impact to your business, you need to decide how much you can adjust your sourcing strategy. Most small businesses do not have strong negotiating power, enough volume, or enough time to entirely overhaul their supply chain. If you own a small business, spend some time looking for alternate suppliers for the same or similar products before attempting to absorb a cost increase. If you have pre-ordered products, ordered custom products, or know there simply isn’t an alternative option, you'll need to determine how to absorb the cost increase.

The bottom line: If you can adapt your ecommerce supply chain, do it. If not, start thinking about how to adapt with margin, pricing, or communication strategies.

How small businesses can respond to cost increases

If tariffs increase your costs and you can’t shift sourcing, you typically have three choices:

Negotiate with your suppliers.

Push for shared accountability on rising costs. Larger businesses — especially US-based providers with leverage — are already doing this. Small businesses should still explore options to reduce pricing or switch to alternative suppliers in countries with fewer disruptions.

This could include exploring product adjustments with your partner, asking to share the tariff cost in order to protect the volume you buy, or using a replacement option as leverage. Don’t mistake small volume as having no leverage; every other business will be thinking about — and having — the same conversations with their suppliers.

If you have pre-paid for an order and now have unexpected tariffs adding to your cost, you will have less leverage. This is common in industries like apparel, hobbies and games, or manufacturing (among many others), where large orders are placed in bulk and delivered all at once. You may have to discuss discounts on future orders or negotiate retroactive price changes to help mitigate tariff costs.

Absorb some of the margin hit.

Small businesses vary widely in their profit margins — from negative-margin, pre-profitability businesses to high-margin, low-volume luxury brands. Depending on the stage of growth for your small business, you will have more or less room to absorb tariffs within your margins. Absorbing tariffs can be a helpful strategy to protect pricing for your customers and can help preserve business volume at the cost of profitability.

This approach is most realistic for ecommerce businesses with high profit margins or customers with high price sensitivity. Think carefully about short-term trade-offs versus long-term brand value and business growth.

Pass on price increases to your customers.

If the above strategies do not offset tariffs, you will be left with raising prices for end consumers. If most businesses in your geography, industry, or similar customer group are raising prices, you will have more flexibility to follow. Regardless of the reason, raising prices must be done thoughtfully.

The bottom line: Most businesses adopt a hybrid strategy. Your response should depend on product type, margin structure, and customer expectations.

What should you consider if you do a pricing increase?

If raising prices is the right move, here are a few approaches to consider, each with different implications:

Silent increase.

Quietly raise prices across key SKUs. This can work well for low-frequency or one-time purchases and is common for ecommerce businesses. Doing a completely silent pricing increase can have risks if you rely on recurring relationships with customers who may feel surprised by a pricing change.

Transparent messaging.

Explain why costs are going up. If you’ve been impacted by US tariffs or retaliatory tariffs, sharing how you’ve negotiated and protected your customers can reinforce brand trust. A temporary promotion may help ease the transition. You can also announce the price increase in advance and attempt to drive a short-term spike in sales. This can give you a boost before the tariff takes effect. Either way, transparent communication can build additional trust with your customers.

Item-specific tariff fees.

Another common approach is to add tariff fees to individual items on your platform, which can help customers disassociate your pricing from the cost of tariffs based on the product’s origin. While this approach does not change the outcome (a higher price), it can help communicate clearly to your customers that the increase is directly tied to tariffs and sourcing.

Offset elsewhere.

Introduce discounts, bundle deals, or smaller formats to offer perceived value. For example, bundling together multiple products to increase average order value would allow you to accept a lower margin on that bundle and offset some tariff effects. These and similar tactics are frequently used by fast-fashion and Amazon sellers navigating global sourcing cost changes. However, these changes are not always easy to implement quickly and may need to supplement immediate price increases or fees.

How to talk to customers about price changes

Ecommerce customers, especially loyal repeat buyers, appreciate honesty. Be upfront about tariff impacts and avoid being vague. Explain what you’ve done behind the scenes to negotiate or delay price increases. If you communicate how you’re dealing with rising costs due to global trade changes, customers are more likely to empathize with you and stick with your brand.

Quick tip for international sellers

If you're selling to international customers, consider offering prepaid duties at checkout. It adds cost but reduces confusion and improves conversion rates. This kind of transparency is also appreciated by customers.

Prepaid duties are especially helpful when dealing with smaller exports where the de minimis exemption may no longer apply. They also help you stay competitive with other international sellers who may appear cheaper upfront but charge more at delivery.

Preparing for uncertainty: tariffs, cash flow, and flexibility

Uncertainty in trade policy — including tariff disruptions and evolving import duties — is likely to continue, especially as elections approach or trade relationships shift under new administrations.

Here’s how to stay prepared:

Stock up early: If new tariffs are announced, consider front-loading key inventory. Focus on high-performing SKUs and factor in storage needs. This depends on your ability to expedite manufacturing and shipping.

Create optionality: Look for alternative sourcing outside of countries most impacted by tariffs to stay agile. Proactively identify alternatives as a negotiating technique, even if tariffs are not immediately affecting you.

Protect cash flow: Don’t overextend. Maintain reserves to handle short-term volatility. Multiple companies have been caught off-guard by large import duties on shipments purchased months or quarters in advance.

Invest while others pause: Market slowdowns are an opportunity. When others retreat, your business can gain ground by reinvesting in operations or customer acquisition. If there is a broader recession, consider investments that can position your business to accelerate out of the slowdown when the market picks up.

The final word

Whether it’s changes to the de minimis exemption, retaliatory tariffs, or shifts in international trade policy, small businesses are navigating more complexity than ever.

Know your sourcing and tariff exposure.

Use supplier relationships to mitigate costs.

Strategically raise prices only when needed.

Offer clarity and prepaid options for international buyers.

Stay agile and prepare for global trade disruptions.

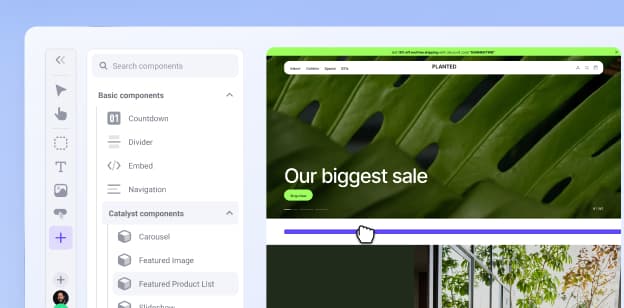

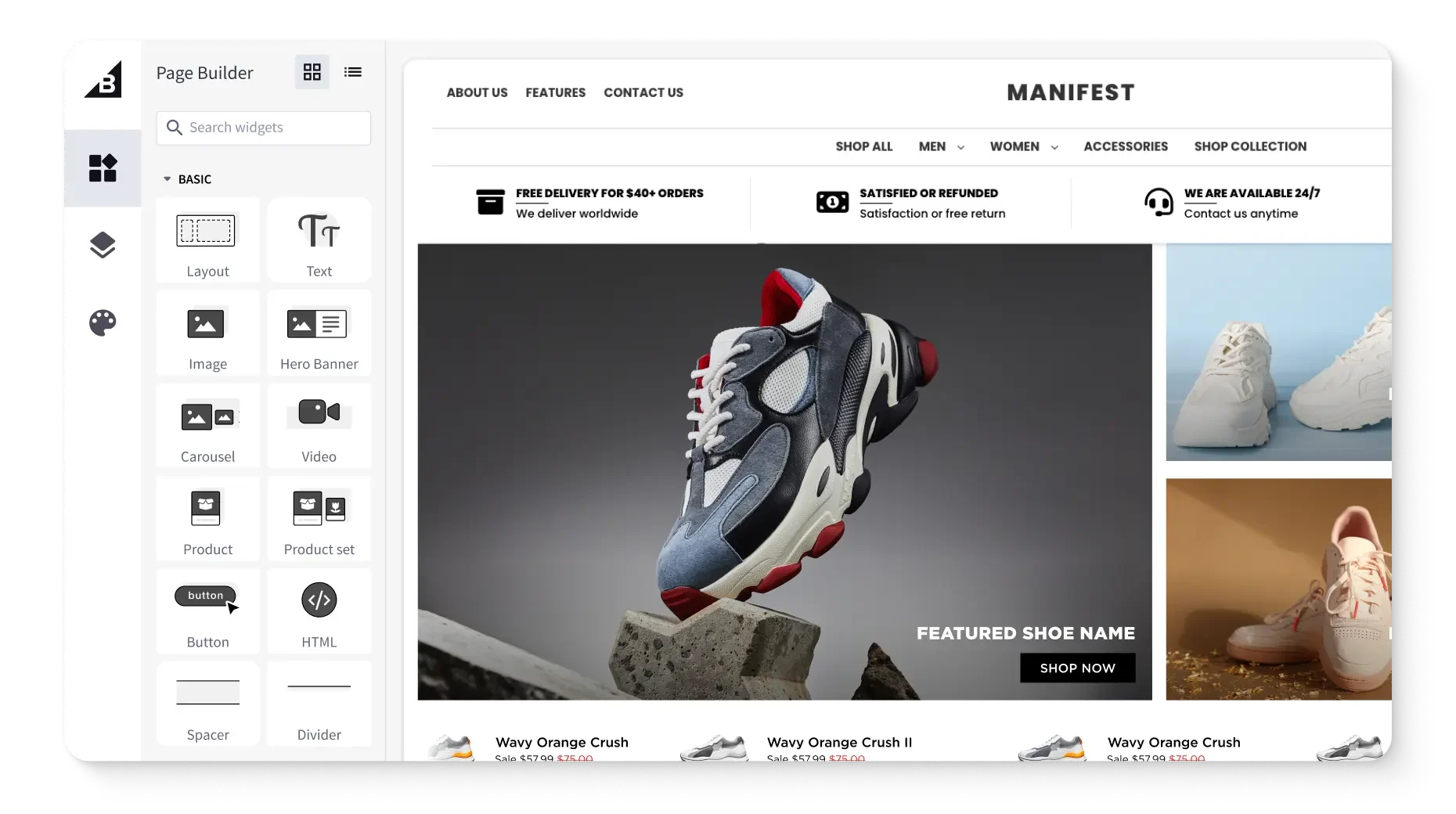

BigCommerce is built to help ecommerce businesses scale through uncertainty — with flexible tools, robust support, and the performance you need to stay competitive in any market condition.

Get a free 15-day trial of BigCommerce.

No credit cards. No commitment. Explore at your own pace.