Offer a better way to pay, by Google

Help provide a frictionless checkout experience for your customers with Google Pay

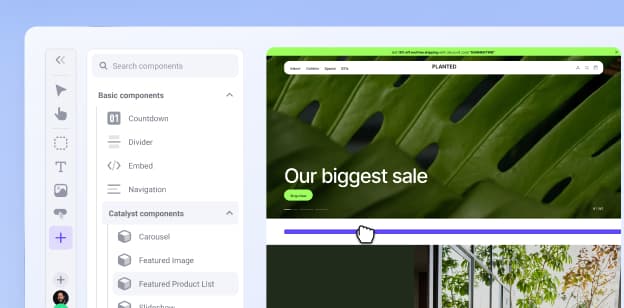

Already using BigCommerce? Activate Google Pay.

Turn potential customers into paying customers with Google Pay

With existing presence in 70+ countries, Google Pay makes checkout a breeze. Plus, customers who have Google Pay selected as their payment type are 65% more likely to complete checkout.*

Offer convenience

Customers can pay everywhere with information stored in their Google account.

Reach more customers

Millions of people already use Google Pay every day.

Reduce friction

Provide an easier checkout experience with as little as two clicks.