About the App

"Get sales tax, VAT, and GST right the first time, every time."

Suited for Small, Medium and Large merchants, ONESOURCE Indirect Tax Determination manages indirect sales tax calculations wherever your customers are purchasing around the world. ONESOURCE Indirect Tax Determination is the all-in-one, #1 sales & use, excise, and VAT tax solution chosen by SMB and Enterprise merchants with B2C and B2B customers. We support over 200 countries and have built-in solution to manage Certificates (US) and Address Validation.

Streamline the entire sales, use, and value-added tax process with our ONESOURCE cloud-based platform that integrates with BigCommerce. Automate transaction tax decisions without the headache of managing and maintaining an in-house tax content or reporting systems. Calculate correct tax amounts in milliseconds and easily handle millions of transactions daily. Our all-in-one tax solution manages all your certificates (US) and all of your global e-invoicing mandates from around the globe!

Effortlessly navigate the ever-changing tax landscape by letting our global tax research team monitor more than 20k global tax jurisdictions in over 200 countries and territories covering sales, VAT, GST and excise taxes — all of which get automatically integrated with your business systems in real time. Better manage your tax requirements with control and consistency and gain a complete view of your tax liability from a single, unified, easy to implement system that's scalable to meet your company's evolving needs.

If you need more information on this ONESOURCE integration to BigCommerce, please contact us at ISVMarketplaces@thomsonreuters.com .

Thank you,

Victoria Walton, Director, ISV Marketplaces @Thomson Reuters

Pricing

Custom Pricing:

Annual Integration Subscription Fee with ONESOURCE License Subscription (must purchase ONESOURCE tax product)

Information

Last Updated:

April 2, 2025

Compatible with:

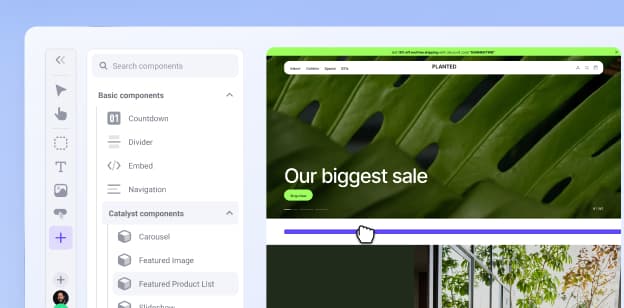

CatalystMulti StorefrontDocumentation:

Installation GuideResources:

Terms of ServicePrivacy PolicyApp Features

Accuracy through automation

Avoid expensive compliance costs, potential penalties and interest, and errors associated with over or under assessing tax.

Trusted tax content

Choose from the most categories for accurate product taxability across the globe.

Proven performance

Calculate correct tax amounts in milliseconds and easily handle millions of transactions daily

Exemption certificate management

Streamline certificate management with reminder notifications and reporting, plus an online portal where customers can enter their own certificates.

Robust reporting

Support your global compliance, reconciliation, and data analysis process with fast and flexible reporting.

Customers who installed this app also installed

There are no slides

Build your online store with BigCommerce

Start your trial today