Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

The Rise of the Amazon Private Label Seller: A Blueprint for Success in 2025

Written by

Nicolette V. Beard25/11/2025

What you'll learn:

Private label is now the dominant Amazon strategy. 54% of sellers use this model, and US private label sales hit a record $271 billion in 2024 — growing faster than national store brands for the third consecutive year.

You don't need massive capital to start. 64% of Amazon sellers launched with less than $5,000. Product line selection and small initial orders let you test demand before scaling.

One product can build a six-figure business. Many successful sellers focus on perfecting 1-3 products rather than spreading resources thin. Master one "hero SKU" before expanding your catalogue.

Sourcing mistakes sink more businesses than bad products. Testing samples, hiring third-party inspectors, and establishing backup suppliers protect you from inventory disasters that wipe out first-time sellers.

Amazon is the launchpad, not the destination. The most resilient brands use Amazon for reach while building direct customer relationships through their own website, reducing dependency on any single platform.

Private label products aren't discount knock-offs anymore.

They're becoming the deliberate choice for millions of shoppers — and a significant revenue driver for innovative retailers.

In 2025, 75% of consumers say private label products offer good value, while 72% view them as strong alternatives to national brands. That's not tolerance — that's trust.

The market agrees.

US private label sales reached a record $271 billion in 2024, growing faster than national brands for the third consecutive year. Retailers from Costco to Target have built billion-dollar businesses on their own branded products.

Amazon sellers are taking notice.

On Amazon, 54% of sellers use a private label model, making it the most common seller strategy. These aren't just resellers slapping logos on generic products — they're brands solving real problems with quality offerings and clever positioning.

This guide shows you how to join them.

You'll learn how to identify profitable products, find reliable manufacturers, navigate Amazon's requirements, and build a brand that competes with (or outperforms) established names.

The opportunity is real. The barriers are lower than you think.

Ebook: How to Stay Ahead in Ecommerce

We surveyed 155 retail executives to see how they're adapting to the ever-changing technology of ecommerce.

What are private label products?

A private label product is made by one manufacturer but sold under a different company's brand.

Here's how it works.

You identify a product opportunity. You rely on a manufacturer for product development. Then brand it with your own logo, packaging and identity. You sell it as your own private label.

Think about it this way:

When you buy Kirkland batteries at Costco, you're purchasing a private label product. Costco doesn't manufacture, but it works with a manufacturer to produce batteries under the Kirkland Signature brand.

The same model works on Amazon, just at a different scale.

What you control:

Product specifications and quality standards

Brand name and logo design

Packaging and presentation

Pricing strategy

Marketing strategies and positioning

What the manufacturer handles:

Production and manufacturing

Quality control during production

Initial product testing

Bulk packaging and shipping

The advantage is differentiation.

National brands compete on duplicate listings. Every seller offers the same Duracell® batteries at roughly the same price.

Private label sellers build their own listings. Your brand. Your story. Your customer relationships.

Done right, you're not just selling products — you're building a business that can grow beyond Amazon.

How to find and sell private label products: A step-by-step guide

Building a private label business requires planning at every stage.

Here's the complete process from idea to first sale.

1. Brainstorm product ideas.

Start with what you know.

Look at items you already use. What frustrates you about them? What's missing? What could work better?

The best product ideas often come from solving problems you've experienced yourself.

Examples of everyday items turned into private label products:

Travel organiser → Niche packing cube sets. Create specialised sets for business travellers, backpackers, or families. Differentiate with unique colours, materials, or configurations.

Dog toy → Pet brand starter product Launch with one well-designed toy. Expand to grooming supplies, leashes, and apparel as you build a following.

Resistance band → Home fitness kit Bundle bands with different resistance levels, a carrying case, and workout guides. Create a complete solution, not just a single product.

Planner → Stationery brand Start with one planner. Add notebooks, pens, stickers, and desk accessories as your brand gains traction.

Makeup bag → Beauty accessories line. Begin with a quality makeup bag. Expand to brushes, mirrors, and organisers once you've proven demand.

2. Consider specific product attributes.

Not all products work well for private label.

Ideal characteristics:

Small and lightweight (lower shipping costs)

Simple to manufacture (fewer quality control issues)

Durable (fewer returns)

Easy to differentiate through design or features

Avoid products that are fragile, highly regulated, or require complex assembly.

3. Conduct market research.

Commit to product research before doing anything.

What to analyse:

Sales volume for similar products

Number of competitors and their pricing

Customer reviews (what do people love? what complaints repeat?)

Keyword search volume

Seasonal demand patterns

Tools that help: Jungle Scout and Helium 10 provide data on sales estimates, revenue and keyword rankings. Both offer free trials.

Look for products with steady demand, manageable competition, and clear opportunities to improve on what's already available.

4. Research product suppliers and manufacturers.

Your manufacturer determines your product quality.

Where to find suppliers:

Alibaba (most common for overseas manufacturing)

Global Sources

ThomasNet (US manufacturers)

Trade shows and industry events

What to verify:

Production capacity

Quality certifications

Minimum order quantities (MOQ)

Payment terms

Communication responsiveness

Always request samples. Test them yourself before committing to a large order.

5. Finalise your logo, design and packaging.

Your branding differentiates you from competitors selling similar products.

Invest in professional design work. Brand visuals are not the place to cut corners.

Where to find designers:

Platform | Best for |

Hiring by project or hourly rate; good for full brand identity work | |

Running design contests to see multiple concepts before choosing | |

Bigger budget customers receive package cover logo, packaging, and print-ready files | |

End-to-end branding, including visual identity and packaging graphics | |

Budget-friendly option for specific deliverables like logo files or packaging mockups |

6. Determine your fulfilment strategy.

You have two options on Amazon private label:

Fulfilment by Amazon (FBA). Amazon stores your inventory, packs orders, ships products, and handles customer service. You pay fees for this service.

Fulfilment by Merchant (FBM). You handle storage, packing, shipping, and customer service yourself.

Most private label sellers choose FBA. It gives you access to Prime shipping (a distinct competitive advantage) and removes logistics headaches.

7. Decide on your manufacturer.

After evaluating samples and quotes, select your manufacturer.

Key factors:

Product quality meets your standards

MOQ fits your budget

Production timeline works for your launch date

Communication is clear and responsive

Establish clear expectations upfront about quality standards, inspection processes and what happens if products don't meet specifications.

8. Create your Amazon listing.

Your listing is your storefront.

Essential elements:

Title: Include primary keywords, brand name, and key features (max 200 characters)

Images: Minimum five high-quality photos showing the product from multiple angles, in use, and with dimension details

Bullet points: Five concise points highlighting benefits (not just features)

Description: Detailed information about materials, use cases, and what makes your product different

A+ content: Enhanced brand content with comparison charts, lifestyle images and brand story (available once you're Brand Registered)

Focus on how your product solves problems, not just what it is.

9. Optimise your listing to increase sales.

Launch is just the beginning.

Ongoing optimisation:

Monitor keywords and SEO rankings and adjust based on what drives sales.

Test different main images (the single greatest factor in click-through rate).

Run Amazon PPC campaigns to increase visibility.

Respond to customer questions quickly.

Address negative reviews by improving the product or clarifying the listing.

Watch your conversion rate. If traffic is high but sales are low, your listing needs work. If sales are good but traffic is low, focus on advertising and keyword optimisation.

How to price private label products on Amazon

Pricing determines both your competitiveness and your profitability.

Start with your costs.

Add up everything:

Manufacturing cost per unit

Shipping to Amazon's warehouse

Amazon referral fees (typically 15% of the sale price)

FBA fulfilment fees (vary by size and weight)

Marketing and advertising costs

Returns and damaged inventory (estimate 2-5%)

Analyse competitor pricing.

What are similar products selling for? Where does quality vary?

You don't need to be the cheapest, but your price needs to make sense relative to what you're offering.

Target a 20-30% profit margin.

This is the healthy range for Amazon's private-label products. It provides room for unexpected costs and reinvestment in inventory.

Example calculation:

Manufacturing cost: $8

Shipping to Amazon: $2

Amazon fees (15% referral + $3 FBA): ~$6

Total cost: $16

Target selling price at 25% margin: $21.33

Round to: $21.99

Pricing strategies to consider:

Cost-plus pricing: Add a fixed markup to your total costs. Simple.

Value-based pricing: Price based on the perceived value to customers. Works when you have superior quality or unique features.

Competitive pricing: Price relative to competitors — slightly below, at or above, depending on your positioning.

Psychological pricing: End prices in .99 or .97. Small difference, measurable impact on conversion rates. Test different price points. A slight increase that doesn't hurt conversion rate can significantly boost profit margins.

5 private label product ideas for 2025

These categories show high demand, manageable competition and clear opportunities for differentiation.

1. Homeschool planner.

Why it works:

Homeschooling continues to grow year-over-year. Parents need organisational tools that actually fit their unique schedules — not generic academic planners designed for traditional schools.

Differentiation opportunities:

Create versions for different grade levels (elementary, middle school, high school).

Include subject-specific sections (STEM focus, arts-based curriculum, etc.).

Add goal-tracking and milestone pages.

Offer undated versions so families can start anytime.

Market size: The homeschool market in the US includes over 3 million students. Parents in this category actively seek specialised tools.

2. Novelty hats.

Why it works:

People buy funny hats for gifts, events, costumes and self-expression. Also, low manufacturing cost and high perceived value help.

Differentiation opportunities:

Target specific interests (gaming, sports teams, pets, professions).

Create seasonal designs (holiday gifts, summer festivals).

Offer matching sets (dad hats for the whole family).

Use quality materials to stand out from cheap alternatives.

Key to success: Stay current with trends and memes. What's funny changes quickly — be ready to adapt designs.

3. Copper measuring cups.

Why it works:

Kitchen aesthetics matter. Home cooks want tools that perform well and look good on the counter or hanging on the wall.

Differentiation opportunities:

Bundle with matching spoons or other copper kitchenware.

Include engraved measurements that won't wear off.

Offer gift-ready packaging.

Create sets for specific uses (baking, cocktail making, coffee brewing).

Market context: The home and kitchen category consistently ranks among Amazon's top sellers. Quality materials like copper justify premium pricing.

4. Reusable food storage bags.

Why it works:

Single-use plastic is out. Consumers want sustainable alternatives that actually work..

Differentiation opportunities:

Use platinum-grade silicone (safer, more durable).

Create different sizes for specific uses (snacks, sandwiches, meal prep).

Add features like write-on labels or colour-coding systems.

Include usage guides showing how to maximise freshness.

Market growth: The reusable food packaging market is projected to grow significantly through 2030 as plastic bag bans expand and eco-conscious purchasing increases.

5. Resistance bands for home fitness.

Why it works:

Home workouts aren't going anywhere. Resistance bands are affordable, portable, and effective — perfect for apartments, travel and budget-conscious fitness enthusiasts.

Differentiation opportunities:

Create complete kits with multiple resistance levels.

Include door anchors and handles for variety.

Add workout guides or QR codes to video demonstrations.

Bundle with carrying bags for travel.

Target specific audiences (seniors, postpartum recovery, physical therapy).

Market context: The global home fitness equipment market continues to experience substantial growth. Resistance bands appeal to beginners and advanced users alike.

What makes these products work?

All five share key characteristics that make them strong private label candidates:

Lightweight and small → Lower shipping costs, easier inventory management.

Clear improvement opportunities → You can differentiate through design, materials, or bundling.

Repeat customers possible → Planners need annual replacement, bands wear out, bags get added to collections.

Searchable demand → People actively search for these products (not impulse-only purchases).

Reasonable competition → Established market, but room for quality-focused brands.

The best product for you depends on your interests, budget and willingness to understand the target customer deeply.

The final word

Private label selling on Amazon isn't a get-rich-quick scheme.

It's a real business that rewards planning, persistence and continuous improvement.

What separates successful sellers from those who quit:

They validate demand before committing capital. They test samples and inspect production runs. They build listings that convert and optimise based on data. They treat cash flow as seriously as product selection.

The path forward is clear.

Start with one well-researched product. Master the fundamentals — sourcing, listing optimisation, PPC and inventory management. Build processes that scale. Then expand strategically: new products, new marketplaces, your own website.

The numbers support the opportunity.

US private label sales hit $271 billion in 2024 and continue growing faster than national brands. Over half of Amazon sellers use the private label model. The majority become profitable within their first year.

But success isn't guaranteed by market conditions. It's earned through execution.

The sellers who succeed a year from now are the ones who start today—with realistic expectations, thorough preparation, and commitment to building something that lasts.

Ready to launch your private label brand?

Explore BigCommerce's ecommerce platform to build your own brand alongside your Amazon presence.

FAQs about selling private label on Amazon

What are some private label myths that keep people stuck?

Misconceptions about selling on Amazon stop many people before they start.

Here's what's actually true.

Myth: "Amazon is too saturated — I'll never stand out."

The reality:

Amazon isn't saturated. It's specialised.

Over 54% of Amazon sellers successfully use the private label model. They're not all fighting over the same generic products — they're finding specific niches and serving them better than anyone else.

How sellers actually stand out:

Superior branding and packaging

Improved product features based on competitor reviews

Better customer service and faster response times

Targeting passionate sub-audiences that major brands ignore

The opportunity isn't in selling another generic phone case. It's in selling the perfect phone case for rock climbers, nurses or motorcyclists.

Myth: "You need thousands of dollars to start."

The reality:

Many sellers start with $1,000-$3,000.

According to 2024 data, 64% of Amazon sellers spent less than $5,000 to start their business, with 25% starting with under $1,000.

How to start with less:

Choose products with lower manufacturing costs ($3-8 per unit).

Negotiate smaller minimum order quantities (500 units instead of 1,000).

Use profits from your first product to fund the second.

Skip unnecessary expenses like premium photography studios when good smartphone photos work.

Starting small lets you test the market and learn without risking everything.

Myth: "You need a huge catalogue to make money."

The reality:

One successful product can build a six-figure business.

Many profitable sellers focus entirely on perfecting 1-3 products rather than spreading resources across dozens. In 2024, 40% of Amazon sellers generated $1,000 to $25,000 per month—many with small, focused catalogues.

Why fewer products often work better:

All your marketing budget goes to one listing

You can perfect the product based on customer feedback

Inventory management stays simple

Customer service is easier to maintain

Once you have a "hero product" generating consistent sales, then you can strategically expand.

Myth: "Only overseas manufacturing is viable."

The reality:

US and nearshore manufacturing can be competitive for the right products.

While 70% of Amazon sellers sourced products from China in 2024, domestic and nearshore options offer real advantages:

Benefits of domestic/nearshore manufacturing:

Faster shipping (days instead of weeks)

Easier communication (same time zone, no language barriers)

Lower minimum order quantities

Quality control is simpler

"Made in USA" appeals to specific customer segments

Reduced shipping disruptions

When to consider domestic:

Products that need frequent iteration based on feedback

Items where "Made in USA" commands premium pricing

Products with rapid trend cycles

When you're starting small and testing demand

The per-unit cost is higher, but the total cost of doing business may actually be lower when you factor in everything.

Myth: "Reviews make or break your product."

The reality:

Zero-review products launch successfully every day.

Reviews matter, but they're not the only factor in early success. According to Amazon seller data, 58% of sellers become profitable within their first year — most starting with no reviews at all.

What actually drives early sales:

High-quality main image that stands out in search results

Competitive pricing for the launch period

Amazon PPC advertising to drive initial traffic

Professional listing copy that addresses customer concerns

Product quality that generates organic positive reviews

Tools to get initial reviews:

Amazon Vine Programme (provides free products to trusted reviewers)

Amazon's "Request a Review" button (automated review requests)

Focus on delivering an excellent product and customer experience. Reviews will follow naturally.

The sellers who fail aren't the ones who start with zero reviews — they're the ones who launch mediocre products with optimistic expectations.

What are the most common sourcing mistakes — and how do I avoid them?

Your supplier determines your product quality. Get sourcing wrong and everything else fails.

Here are the mistakes that sink new sellers.

Mistake #1: Skipping sample testing.

The problem:

Product photos lie.

That sleek-looking item in Alibaba photos might be made from cheap plastic, have visible seams, or break after two uses. Trusting photos alone is gambling with your inventory budget.

How to avoid it:

Order samples from your top 2-3 suppliers before committing to anything. Test them the way a customer would:

Use the product daily for at least a week

Check materials, weight, and finish quality

Look for weak points that might cause returns

Compare all samples side-by-side

A $50-$100 investment in samples can save you from $5,000 worth of unsellable inventory.

Mistake #2: Skipping quality control inspections.

The problem:

A perfect sample doesn't guarantee an ideal production run.

Factories sometimes cut corners on bulk orders — cheaper materials, rushed assembly, inconsistent quality. With Amazon FBA, defective products go straight to fulfilment centres. By the time you discover the problem, you've already paid for shipping and storage on inventory you can't sell.

How to avoid it:

Hire a third-party inspection service to check your order before final payment and shipping.

What inspectors do:

Random sampling from your production batch

Compare production units against your approved sample

Document defects with photos

Give you leverage to demand fixes before shipping

Services like QIMA and V-Trust typically cost $200-400 per inspection — far less than a ruined inventory shipment.

Never release the final payment until inspection passes.

Mistake #3: Relying on a single supplier.

The problem:

One supplier means zero leverage.

They can raise prices, experience production delays, or go out of business. If that happens, your Amazon listings go out of stock and your sales momentum disappears.

How to avoid it:

After selecting your primary manufacturer, establish a relationship with at least one backup supplier.

Benefits of supplier diversity:

Negotiating power on pricing and MOQs

Protection against production delays or factory closures

Ability to compare quality over time

Flexibility if demand exceeds your primary supplier's capacity

You don't need to place orders with your backup immediately, but have them ready to go.

Mistake #4: Ignoring certifications and compliance.

The problem:

Many product categories require specific safety certifications. Selling non-compliant products can result in:

Listing suspension

Inventory destruction at your expense

Legal liability

Permanent account restrictions

Common certification requirements:

Children's products (US): Children's Product Certificate (CPC), CPSIA testing

Electronics: FCC certification (US), CE marking (Europe)

Beauty and cosmetics: FDA registration

Supplements: FDA facility registration, cGMP compliance

Toys: ASTM F963 testing (US)

How to avoid it:

Research certification requirements before you source — not after. Ask suppliers for copies of existing certifications and verify their authenticity.

If your supplier can't provide the required certifications, either find one who can or budget for independent testing (often $500-$2,000 depending on product type).

Amazon will ask for compliance documentation. Have it ready.

Mistake #5: Not modifying the product.

The problem:

If you slap your logo on a generic product, your supplier can sell that same item to your competitors tomorrow.

Nothing is stopping another seller from listing an identical product at a lower price.

How to avoid it:

Work with your manufacturer to make modifications that create real differentiation:

Types of modifications:

Material upgrades: Better fabric, thicker plastic, more durable components

Feature additions: Extra pockets, improved handles, added functionality

Bundling: Include complementary accessories that competitors sell separately

Custom packaging: Professional presentation that signals quality

Design changes: Different colours, shapes or sizes for underserved segments

Even minor modifications make your product harder to copy and give customers a reason to choose you over generic alternatives.

The goal isn't just branding. It's building something genuinely better.

Key takeaway:

Most sourcing mistakes come from rushing. Take time to test samples, verify quality, establish backup suppliers, confirm compliance and differentiate your product.

The extra weeks spent on sourcing due diligence can save months of recovery from a failed product launch.

What hidden costs should I budget for when launching on Amazon?

Your per-unit manufacturing cost is just the beginning.

Ignoring these additional expenses is how sellers run out of cash mid-launch.

Pre-production costs.

Samples and prototyping.

Budget: $100-$300

You'll order samples from 2-3 suppliers, plus international shipping. Each sample might cost $10-$50, with shipping adding $30-$100, depending on speed and origin.

Tooling and mould fees.

Budget: $0-$2,000+

If you're creating custom moulds for unique products or packaging, manufacturers charge one-time setup fees. Simple modifications might cost nothing extra. Complex custom designs can run into thousands.

Ask your manufacturer upfront: "Are there any tooling or setup fees?"

Getting products to Amazon.

Shipping and import duties.

Budget: 20-40% of product cost

Your "landed cost" includes:

Factory price

Freight shipping (sea is cheaper but slower; air is faster but 4-5x more expensive)

Customs brokerage fees ($50-$150 per shipment)

Import duties/tariffs (varies by product category — often 5-25% of declared value)

A $5 manufacturing cost can easily become $7-$8 landed. Calculate this before setting your selling price.

Customs tip: Look up your product's HTS code to find exact duty rates before you commit to an order.

Listing and launch costs.

Professional listing assets.

Budget: $200-$1,000

What you need:

Product photography (5-7 high-quality images minimum)

Infographics showing features and dimensions

Lifestyle photos showing the product in use

A+ Content graphics (if Brand Registered)

Options range from DIY smartphone photos ($0) to professional Amazon photography services ($500-$1,500).

Quality matters — your main image is the heavyweight in click-through rates.

Amazon PPC advertising.

Budget: $500-$2,000 for launch period

New products don't rank organically. Amazon advertising adoption continues growing among sellers, and PPC is essentially required for visibility during launch.

Plan for 4-8 weeks of advertising spend before your organic rankings stabilise. Some sellers spend more aggressively; others stretch smaller budgets over longer periods.

Start with automatic campaigns, then optimise toward profitable keywords once you have data.

Ongoing Amazon fees.

FBA storage fees.

Monthly fees based on inventory volume:

Standard-size: ~$0.87 per cubic foot (January-September), ~$2.40 (October-December)

Oversize: Higher rates apply

Aged inventory surcharges.

Products stored for over 181 days incur additional fees. After 365+ days, fees increase significantly.

Lesson: Don't over-order. Start with 2-3 months of inventory and reorder based on actual sales velocity.

Referral fees.

Amazon takes a percentage of each sale, typically 15% for most categories (some vary from 8-45%).

FBA fulfilment fees.

Per-unit fees for picking, packing and shipping. Varies by size and weight:

Small standard items: ~$3.00-$4.00

Large standard items: ~$4.50-$6.50

Oversize: $8.00+

Loss and contingency costs.

Returns processing.

Budget: 2-5% of sales

Returns happen. Amazon charges fees to process them, and returned items often can't be resold as new. Categories like apparel and electronics typically see higher return rates.

Removal and disposal fees.

If inventory becomes unsellable (damaged, expired or just not moving), you pay Amazon to either return it to you or dispose of it:

Removal: ~$0.50-$1.00 per unit

Disposal: ~$0.30-$0.50 per unit

Inventory write-offs.

Budget: 3-5% of initial inventory value

Account for when inventory becomes “unsellable” in your profit calculations.

Sample launch budget breakdown.

Here's an example of what a first product launch might cost based on the expenses mentioned above:

Expense Category | Conservative | Moderate |

Samples and shipping | $150 | $300 |

First inventory order (500 units) | $2,500 | $4,000 |

Shipping and duties | $600 | $1,000 |

Photography and graphics | $200 | $600 |

Initial PPC budget | $500 | $1500 |

Contingency (10%) | $400 | $740 |

Total | $4,350 | $8,140 |

These numbers vary significantly based on product category, manufacturing complexity, and how aggressively you want to launch.

The point isn't hitting an exact number — it's budgeting realistically so you don't run out of money before your product gains traction.

Key takeaway:

Most new sellers underestimate costs by 30-50%. Build a detailed spreadsheet with every expense before you place your first order.

Cash flow kills more private label small businesses than bad products do.

How do private label sellers actually spend their days?

The work changes dramatically as your business matures.

Here's what to realistically expect.

Launch week: High intensity, constant adjustments.

Launch week is not passive. Expect to spend several hours daily on:

PPC campaign management.

Monitor ad spend and adjust bids.

Add negative keywords to eliminate wasted clicks.

Test different keyword match types.

Watch cost-per-click trends.

Listing performance tracking.

Confirm your listing is indexed for target keywords.

Monitor sales velocity hour by hour.

Check for suppressed listings or indexing issues.

Watch for your first reviews.

Problem-solving.

Respond to early customer questions.

Address any inventory or listing errors.

Make quick adjustments based on initial data.

This phase requires focus. Many sellers take time off from other commitments during launch week to stay responsive.

Ongoing operations: Predictable weekly rhythms.

Once your product stabilises, the work shifts to maintenance mode.

Inventory management (most critical).

Running out of stock kills momentum. Overstocking triggers storage fees.

Weekly tasks:

Review sales velocity and adjust forecasts

Calculate reorder timing (factor in manufacturing and shipping lead times)

Monitor Amazon's inventory health reports

Plan for seasonal demand changes

Supplier communication.

Regular check-ins with your manufacturer:

Discuss upcoming production runs

Address quality issues from customer feedback

Negotiate pricing on larger orders

Explore product improvements for future versions

Campaign optimisation.

PPC doesn't run itself effectively:

Review search term reports weekly

Adjust bids on profitable and unprofitable keywords

Test new keyword opportunities

Monitor advertising cost of sale (ACoS) trends

Time commitment: Most established sellers spend 5-15 hours per week on a single mature product. Multiple products multiply the workload.

How passive does it actually get?

The "passive income" framing is misleading.

A private label business is an active asset that requires ongoing attention. However, you can systematise it over time.

What can be automated or outsourced:

PPC bidding (tools like Perpetua or Pacvue)

Inventory reorder alerts (SoStocked, InventoryLab)

Customer service responses (virtual assistants, templates)

Financial tracking (Sellerboard, My Real Profit)

What still requires your attention:

Strategic decisions about new products

Major supplier negotiations

Responding to competitive threats

Handling listing suspensions or account issues

Realistic progression:

Months 1-3: Near full-time effort (30-50 hours/week)

Months 4-12: Part-time management (15-25 hours/week)

Year 2+: Systematised oversight (5-15 hours/week per product)

The goal isn't zero work—it's building something valuable that doesn't require trading hours for dollars at a 1:1 ratio.

Tools most sellers use.

Product and keyword research.

PPC automation and analytics.

Inventory management and forecasting

Financial analytics and profit tracking

Most sellers start with one research tool (Helium 10 or Jungle Scout) and add others as their business grows and specific needs emerge.

The honest trade-offs.

Challenges to expect:

Cash flow pressure: Your money is tied up in inventory. Growth requires capital.

Isolation: Solopreneurs work alone. No coworkers, no water cooler chat.

Stress spikes: Stock-outs, listing suspensions and new competitors create anxiety.

Unpredictability: Algorithm changes, fee increases and policy updates happen without warning.

Benefits that keep sellers going:

Flexibility: Work from anywhere with internet access.

Ownership: You're building a sellable asset, not just earning a paycheck.

Direct control: Your decisions directly impact your results.

Scalability: Revenue can grow without proportional time increases.

According to 2024 data, 58% of Amazon sellers become profitable within their first year. The ones who succeed typically treat it as a real business — not a get-rich-quick scheme.

Key takeaway:

Private label selling starts as a job and evolves into a business you manage. The path to "passive" runs through months of active work building systems, optimising processes, and creating something that runs efficiently.

If you're looking for truly hands-off income, this isn't it. If you want to build your own product that you control, it can be worth the effort.

How can I use AI and automation to improve my Amazon operations?

Manual processes don't scale.

As your business grows, AI and automation handle the data-heavy tasks so you can focus on strategy.

Here's where these tools can make a difference.

PPC bidding and optimisation.

The problem:

Managing bids across hundreds of keywords is time-consuming. Optimising for time of day, competitor activity, and profitability targets requires constant monitoring that no human can sustain.

What AI tools do:

Analyse campaign performance 24/7

Adjust bids automatically to hit your target ACoS

Shift budget from underperforming campaigns to winners

Identify and add negative keywords to reduce wasted spend

Discover converting search terms and add them as keywords

Tools: Perpetua, Pacvue, SellerApp, Adtomic (Helium 10)

Result: Lower ACoS, better budget efficiency, and hours saved weekly on campaign management.

Listing optimisation.

The problem:

Writing copy that ranks well in Amazon search and converts browsers into buyers requires extensive keyword research and competitive analysis.

What AI tools do:

Analyse top-ranking competitor listings

Mine customer reviews and Q&A for language patterns and pain points

Identify high-traffic keywords you're missing

Generate draft titles, bullet points, and descriptions

Suggest improvements based on conversion data

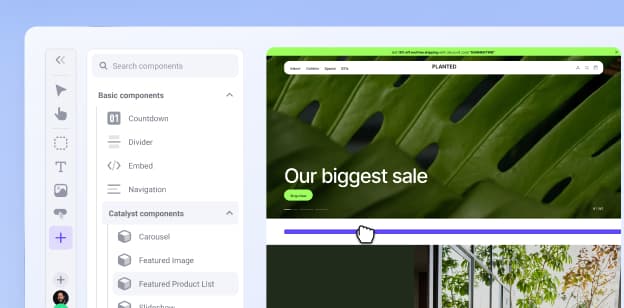

Tools: Helium 10's Listing Builder, Jungle Scout's Catalyst, ChatGPT (with your own keyword research)

Result: Faster listing creation, better keyword coverage, and copy that speaks directly to customer concerns.

Note: AI generates drafts. You still need to refine for brand voice and accuracy.

Dynamic pricing.

The problem:

Optimal pricing changes constantly based on competitor prices, inventory levels, and sales velocity. Manual tracking and updating are inefficient and reactive.

What AI tools do:

Monitor competitor pricing in real time.

Adjust your price automatically based on rules you set.

Raise prices when competitors stock out (maximise profit).

Lower prices strategically to win the Buy Box or clear ageing inventory.

Protect the minimum margins you define.

Tools: Informed.co, RepricerExpress, Seller Snap

Result: Higher Buy Box ownership, protected margins and competitive positioning without constant manual price checks.

Inventory forecasting.

The problem:

Guessing wrong on inventory is expensive either way. Too much inventory ties up cash and triggers storage fees. Too little causes stock-outs that tank your rankings.

Amazon FBA sellers save about 70% per item shipped compared to major US carriers, but those savings disappear fast if you're paying aged inventory surcharges or losing sales to stock-outs.

What AI tools do:

Analyse historical sales data and seasonal patterns.

Factor in current trends, promotions, and lead times.

Generate demand forecasts with reorder recommendations.

Alert you when it's time to place orders.

Tools: SoStocked, InventoryLab, Forecastly

Result: Fewer stock-outs, lower storage fees, and better cash flow management.

Review and feedback management.

The problem:

Requesting reviews consistently and responding to negative feedback quickly matters for rankings and reputation, but it's tedious to do manually.

What automation tools do:

Send review requests to eligible buyers at optimal times.

Monitor listings for new reviews in real time.

Alert you immediately when negative reviews appear.

Use sentiment analysis to draft appropriate responses.

Track review velocity and ratings trends.

Tools: FeedbackWhiz, Jungle Scout's Review Automation, Amazon's Request a Review button (free, but manual)

Result: Higher review rates, faster response to negative feedback, and better account health metrics.

Where to start.

You don't need every tool immediately. Prioritise based on your biggest bottleneck:

If your problem is | Start with |

Wasting ad spend | PPC automation (Perpetua, Pacvue) |

Low conversion rates | Listing optimisation (Helium 10, Jungle Scout) |

Losing the Buy Box | Dynamic repricing (Informed.co, Seller Snap) |

Stock-outs or overstocking | Inventory forecasting (SoStocked) |

Low review count | Review automation (FeedbackWhiz) |

Most sellers add tools gradually as revenue justifies the subscription costs. Start with one, learn it well, then expand.

Key takeaway:

AI and automation don't replace strategy — they execute it at scale. The sellers who win aren't doing everything manually. They're building systems that work while they sleep.

When should I sell outside of Amazon?

Amazon is the best place to launch. It's not always the best place to stay exclusively.

Understanding when to expand — and why — is the difference between being an "Amazon seller" and building a lasting brand.

The risks of Amazon-only selling.

Rising and unpredictable fees.

Amazon's fees are substantial: referral fees (typically 15%), FBA fulfilment fees, storage fees, and advertising costs. These can increase at any time without negotiation.

Over half of Amazon sellers reported profit margins exceeding 10%, with 28% achieving margins above 20%. But those margins shrink when fees increase — and you have no control over when that happens.

Algorithm and policy vulnerability.

Your visibility depends entirely on Amazon's A9 search algorithm. A single update can tank your rankings overnight.

Listing suspensions — sometimes erroneous — can halt revenue instantly. Account reinstatement can take days or weeks. During that time, an Amazon-only business earns nothing.

Intense competition you can't escape.

On Amazon, competitors are one click away. Hijackers may attempt to sell counterfeits on your listing. And Amazon itself may launch competing products in your category.

You're building on rented land. The landlord can change the rules anytime.

When diversification makes sense.

Because the Amazon brand is synonymous with online sales, expanding off-Amazon isn't right for everyone immediately. Consider it when:

Your product has consistent sales and positive reviews.

You're spending heavily on Amazon PPC with diminishing returns.

You've built brand recognition (customers search for your brand name).

Amazon fees are significantly cutting into margins.

You want to create subscription or bundle offerings, but Amazon doesn't support them well.

You're concerned about account suspension risk.

If you're still launching and iterating, stay focused on your Amazon business. If you're established and profitable, diversification becomes strategic.

The advantages of selling on your own website.

You own the customer relationship.

On Amazon, buyers are Amazon's customers. You get limited data and strict rules about communication.

On your own site, you own the customer list. You can:

Build an email list for direct marketing.

Retarget customers with ads across platforms.

Analyse purchase behaviour and repeat rates.

Calculate Customer Lifetime Value (LTV).

This direct relationship is how brands build loyalty that survives platform changes.

You control your margins.

Yes, you'll have new costs: website hosting, payment processing (2-3%), and your own marketing spend.

But you eliminate Amazon's 15% referral fee. You control pricing, promotions, and bundling without Amazon's rules. Many sellers see higher net profit per order on their own site—even with marketing costs factored in.

You build a brand, not just a listing

Amazon listings are templated. Every seller looks similar.

Your own website is a blank canvas:

Tell your brand story.

Create content that builds trust (blog posts, videos, guides).

Design an experience that reflects your identity.

Build a community around your products.

This is how you move from commodity seller to recognised brand.

You diversify risk.

If your Amazon listing gets suspended tomorrow, an Amazon-only business drops to zero revenue.

A multi-channel brand keeps generating sales through its website, email list, and other marketplaces. That safety net makes your business more stable — and more valuable if you ever want to sell it.

Where to sell beyond Amazon.

Your own website (DTC).

Platforms like Shopify, BigCommerce or WooCommerce let you launch quickly. Start simple — you can add complexity as you learn what works.

Other marketplaces.

Walmart Marketplace (growing rapidly, less competition than Amazon)

eBay (still significant traffic for certain categories)

Target Plus (invitation-only, but worth pursuing for established brands)

Etsy (if your product fits handmade/artisan positioning)

Wholesale and retail.

Once your brand has traction, retail buyers may approach you—or you can pitch them. This opens doors to physical retail distribution.

How to start.

Don't try everything at once.

Phase 1: Launch a simple Shopify or BigCommerce store. Mirror your Amazon listings initially.

Phase 2: Build an email list. Offer a discount for signing up. Start collecting customer data.

Phase 3: Drive traffic to your site by running small-scale ads. Test whether you can acquire customers profitably outside Amazon.

Phase 4: Once DTC is working, consider additional marketplaces like Walmart.

The goal isn't to abandon Amazon — it's to reduce dependency on any single channel.

Key takeaway:

Amazon is a powerful launchpad, but it's a risky place to build your entire business. The most resilient private label brands use Amazon for reach while building direct customer relationships that they actually own.

Start on Amazon. Grow beyond it.

How do I expand my private label brand to international Amazon marketplaces?

International expansion can significantly scale your business.

But copying your US listing to Amazon UK or Germany doesn't work. Success requires localisation, compliance, and understanding regional differences.

Here's what's actually involved.

Step 1: Validate demand in the new market.

Don't assume your US bestseller will sell abroad.

Consumer preferences, competition, and pricing vary significantly by country. A product crushing it in the US might have saturated competition in Germany or zero demand in Japan.

How to research:

Use Helium 10 or Jungle Scout with international marketplace data.

Analyse local search volume and sales estimates.

Browse the target marketplace manually. See how competitors position similar products.

Read local customer reviews to understand what features matter in that market.

Check pricing norms (what's "affordable" varies by country).

Look for gaps: categories where demand exists but competition is weaker than in the US.

Step 2: Localise everything (not just translate).

Language matters more than you think.

Do not use Google Translate. Hire a native speaker who understands ecommerce and local search behaviour.

Why this matters:

Search terms differ by region (UK customers might search "torch" while US customers search "flashlight").

Slang and phrasing affect conversion rates.

Poorly translated listings signal "foreign seller" and reduce trust.

Localise your keywords, not just your copy.

Packaging and inserts:

Your packaging must comply with local laws:

Correct measurement units (millilitres, grams, centimetres — not ounces, pounds, inches)

Required safety warnings in the local language

Legally mandated symbols (CE mark for Europe, UKCA for UK)

Proper labelling for regulated categories

Getting this wrong can result in inventory seizure at customs.

Step 3: Handle compliance and certifications

Product regulations vary by region.

Categories like electronics, toys, cosmetics, and food-contact items face strict requirements in the EU and UK. You're legally responsible for compliance.

Key certifications:

CE marking: Required for many products sold in the EU (indicates conformity with health, safety, and environmental standards)

UKCA marking: Required for products sold in the UK post-Brexit

Category-specific requirements: REACH compliance for chemicals, RoHS for electronics, EN 71 for toys

Check requirements before you ship. Non-compliant products get stopped at customs or removed from product listings.

Step 4: Register for VAT and import compliance.

VAT (Value-Added Tax) is non-negotiable.

If you store inventory in the UK or EU, you must:

Register for a VAT number in each country where inventory is stored

Collect VAT on each sale (built into your listing price)

File regular VAT returns and remit taxes to authorities

Most sellers use third-party VAT services (like Avalara, SimplyVAT or hellotax) to manage registration and filing across multiple countries.

Import requirements:

You need an EORI (Economic Operators Registration and Identification) number to import goods into the UK or EU.

You also need to act as the "Importer of Record," legally responsible for the shipment. Work with a freight forwarder or customs broker experienced with Amazon FBA to ensure duties and taxes are paid correctly.

Skipping these steps leads to inventory seizures, fines and account suspension.

Step 5: Price for profitability (not just currency conversion).

Converting your US price to euros doesn't work.

Your international price must account for:

Landed cost (manufacturing + international shipping + import duties)

Local Amazon FBA fees (different by marketplace)

VAT (included in the displayed price, unlike US sales tax)

Marketing costs in the new market

Currency fluctuation buffer

Example: A product priced at $24.99 in the US might need to be €29.99 in Germany to maintain similar margins after all costs.

Use psychological pricing in local currency (€19.99, £24.99) and build in margin protection against exchange rate swings.

Step 6: Choose your European fulfilment method.

You have two main FBA options in Europe:

European Fulfilment Network (EFN).

Store inventory in one country (typically Germany or the UK). Amazon fulfils orders across Europe from that single location.

Pros:

Simpler setup

Only one country's VAT registration is needed initially

Lower upfront complexity

Cons:

Higher cross-border fulfilment fees

Slower delivery to customers in distant countries

Less competitive for Prime delivery promises

Best for: Testing new markets, lower sales volume

Pan-European FBA

Send inventory to one fulfilment centre. Amazon automatically distributes stock across warehouses in multiple EU countries based on demand.

Pros:

Faster delivery to customers

Lower fulfilment fees

Better Prime badge competitiveness

Cons:

Requires VAT registration in every country where inventory is stored

More administrative complexity

Higher compliance burden

Best for: Established products with proven demand, higher sales volume

Expansion roadmap.

Phase 1: Single marketplace test.

Pick one international marketplace (the UK or Germany are common starting points). Validate demand, work through compliance and learn the process.

Phase 2: Expand within the region

Once profitable in one EU marketplace, expand to others using EFN. Add VAT registrations as volume justifies.

Phase 3: Scale with Pan-European FBA

When sales volume supports it, switch to Pan-European FBA for better customer experience and lower per-unit costs.

Phase 4: Consider other regions

Japan, Australia and Canada each have their own Amazon marketplaces with different requirements and opportunities.

Key takeaway:

International expansion multiplies your addressable market, but it also multiplies complexity. Start with one marketplace, get the compliance and logistics right, then scale methodically.

The sellers who succeed internationally treat each new market as its own launch, not an afterthought.

How do newer sellers navigate alternative models and tools when building ecommerce private label brands?

New Amazon sellers often compare private label with other approaches like Amazon Basics, dropshipping, arbitrage or even traditional grocery store merchandising. While each model has its place, private label remains the strongest path for long‑term growth because you control your own products.

Ebook: Win Customers Across Every Channel

Get expert insights on data, branding, and marketing strategies to grow sales on every major ecommerce channel.