A Complete Guide to Customer Acquisition Cost

What would you give to acquire a new customer? 10 dollars? A thousand? Your right arm? Would you give someone an apple if you knew that, instead of returning one apple, in a few years, they would give you 20?

According to Statista, global marketing spend was set to reach 1.3 trillion in 2020. In the same period, US online media outlay increased by eight percent, up to 168.4 billion. At first glance, it can look like businesses are simply throwing money at the wall in an attempt to acquire new customers – but there’s a strategy to this spending (or there should be).

There are many costs to doing business: staff salaries, storage, distribution, order processing costs… The list goes on. Ad and marketing spend must be balanced by paying customers to maintain profitability. Whether a startup or a well-seasoned company, you must optimize the cost to acquire new customers.

When it comes to getting them, you have to expect to spend some of your hard-earned cash – there’s no other way to do it. This is because the cost of acquisition is much greater than the cost of retaining customers. When done correctly, however, that spending is a sound long-term investment.

Ecommerce businesses today are always looking for ways to pull in new customers. According to a recent CMO survey by Duke University, 72 percent of marketers believe the role of marketing has increased in importance. The amount of firms focusing on new acquisitions as their priority has also increased by nearly 50 percent. Businesses should thus invest a lot of resources into meeting their customers in relevant digital spaces.

Marketing expenses today include lots of spending on technology solutions. These are services like customer relationship management (CRM) and omnichannel marketing tools. Messaging apps and social media are also ever-evolving spaces for businesses to interact with and gain new customers.

Almost every business is looking to grow its customer base. For this reason, it’s s important to have an understanding of what customer acquisition cost is and how to accurately calculate it. That’s what we’ll explore in this article.

What is Customer Acquisition Cost?

In formal terms, customer acquisition cost (CAC) is the total expenditure needed for a business to acquire one new customer. To calculate this, a business needs to have an accurate total for its spending on sales and marketing for a defined period. This includes things like employee salaries and advertising costs. This must be compared against the total acquired number of customers from the same period.

Once CAC is calculated, it’s not very useful on its own. It first needs to be provided with some context. An eCommerce website dealing in fashion can expect customers to need less convincing than, say, a SaaS vendor selling a B2B service via subscription.

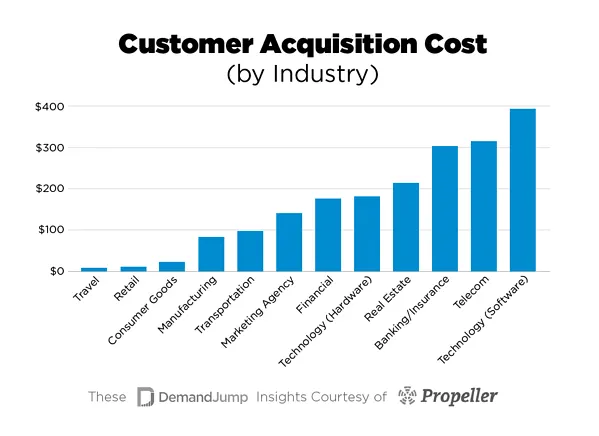

Image source: Demand Jump

As such, the cost per acquisition varies between industries. According to Propeller, the average CAC for different industries looks something like this:

Travel: $7

Retail: $10

Consumer Goods: $22

Manufacturing: $83

Transportation: $98

Marketing agency: $141

Financial: $175

Technology (hardware): $182

Real estate: $213

Banking/insurance: $303

Telecom: $315

Technology (software): $395.

This makes it look like starting a travel agency would be much more valuable than creating a SaaS product, but CAC is only one side of the story when it comes to running a business. When acquisition costs are compared to average customer spending, then can we get a clear picture of the health of a business model.

Customer acquisition cost is part of the cost of goods sold (COGS). Therefore, it’s an important contributor to the gross profit margin formula for your business.

What Does CAC Include?

Before you can get a grip on your business’ CAC, you need to compile an account of your total spending. Some expenses may be obvious, but others may form part of the hidden cost of acquiring new customers.

1. Employee Salaries.

The wages spent on your sales team and marketers are a major cost for any business. When calculating CAC, one must also take into account any sales support staff, including IT. It all depends on the nature of your business model and how it markets and sells to its target audience.

For ecommerce, it’s important to reduce customer friction by eliminating as many human touchpoints as possible. This will not only save on spending but enable you to acquire customers 24/7.

2. Tech Stack Costs.

When it comes to your website, all of the technologies used to run your online shop contribute to CAC. This includes platforms to build and develop your site and mobile app and tools like your customer relationship management (CRM) platform and analytics.

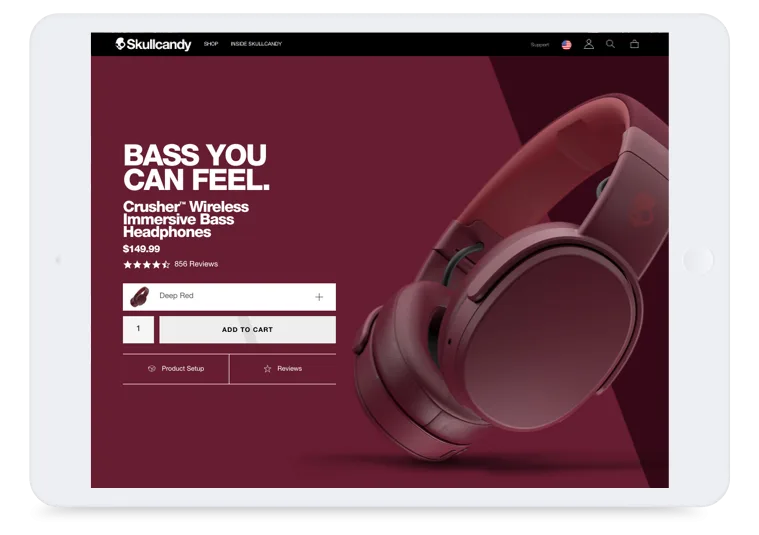

Image source: BigCommerce

For example, not so long ago, lifestyle audio brand Skullcandy was looking for an adaptable, versatile, and affordable eCommerce platform to take its company to the next level. With BigCommerce, they found easy client access via ready-made, third-party integrations for things like Yotpo for product reviews and Klavyio for email marketing.

Skullcandy not only found a cost-saving platform but was able to see an increase in site traffic of 104 percent and a 50 percent increase in conversion rate.

3. Ad Spend.

Ad and marketing spend is the lifeblood of any sales pipeline. You might be using ads to drive visitors to your website, gain signups, hit landing pages, or increase eBay sales. Whether using Google Ads, Facebook Ads, or another option, you’ll spend a significant amount per customer on clicks, signups, or other types of leads generated by ad spending.

That being said, a strong marketing campaign can nonetheless deliver an increase in traffic, sales, visibility, and more. This means that – done properly – the benefits can most definitely outweigh the costs.

4. Content Production Costs.

Content marketing has its own costs. Let’s say you want to do a virtual video tour for your product. Well, now you need to add in the cost of filming said video. This could include hiring a third party or supplying your own filming equipment and crew.

This applies to any type of content creation, from blogs and podcasts to social media posts or even spending to make infographics.

5. Inventory Maintenance.

Depending on the nature of your product, there are also inventory upkeep costs. These can vary widely between ecommerce businesses. A SaaS provider may incur significant costs maintaining its freemium products in the hope of growing its customer base, for example.

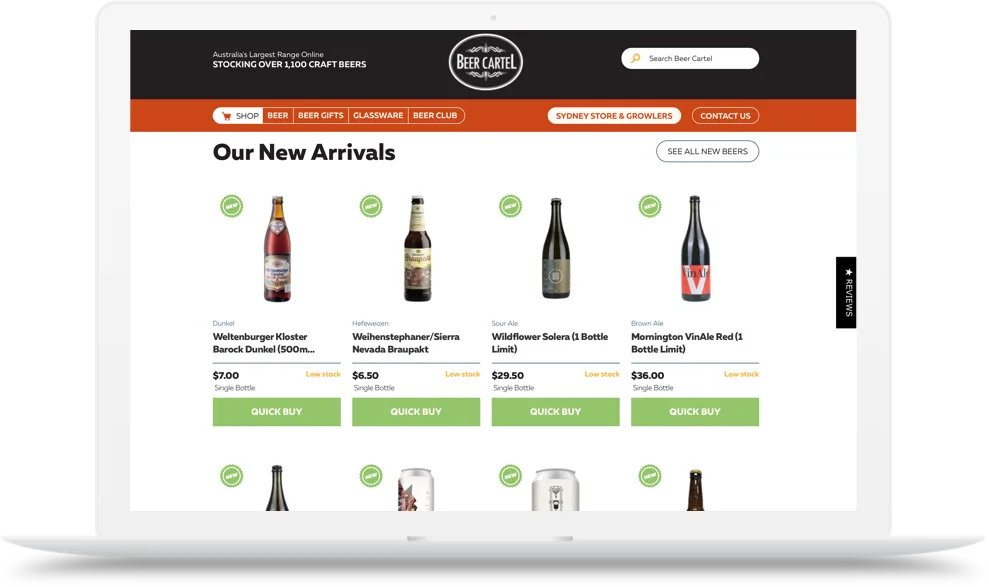

Image source: BigCommerce

Take e-merchant Beer Cartel. Initially started in a storage shed, it soon required a brick-and-mortar warehouse to store over 1,000 different beers. Its products had to be stored in proper conditions too.

Regardless of your fulfillment strategy, many products will have a limited shelf-life. Having this product available for new customers whenever they want to place an order is thus part of a business’s acquisition costs.

In our example, having a wider range of products was arguably an investment to help Beer Cartel acquire new customers. With the help of the BigCommerce platform, that investment paid off. Beer Cartel was able to better utilize challenges like Google, Facebook, and email. And, despite increasing costs, it saw a 300% increase in its sales.

CAC Formula

Once a business has fully accounted for all spending on sales and marketing, they need another set of information: the total number of new customers acquired. For this to make any sort of sense, each total should be for a given period. This can be annual, quarterly, monthly, or whatever suits the company’s needs.

The formula to calculate CAC is:

Total sales costs + total marketing costs

——————————————————– = CAC

Total number of new customers acquired

Seven Ways to Reduce Ecommerce Customer Acquisition Costs

Optimizing CAC is a challenge for any ecommerce business. It-s a balancing act – one that should not be taken lightly.

With this in mind, here are seven ways to reduce your expenditure.

1. A/B Test Your Campaigns.

Looking at the CAC formula, we can see that gaining more conversions can decrease customer acquisition spending. There’s no better way to improve your online marketing efforts than the simple A/B test.

You can test landing pages, web copy, Google Ads, and just about anything your team can come up with. Change things like headlines, color schemes, calls to action (CTAs), and more to see what works best and optimize your marketing efforts.

Make sure you’re using Google Analytics or a similar tool to help you.

2. Retarget Website Visitors.

Many customers will browse a website and then abandon it before making a purchase. Retarget these site lurkers with ad platforms like Google and Facebook. It’s quite simple: with retargeted marketing, these lukewarm customers will encounter your ads while visiting other websites.

To get the best results, you can segment potential customers based on what pages or products they visited on your website.

This is useful because you already know these customers have an interest in your product and are inclined to buy from you. This makes them easier and less expensive to acquire than a completely fresh prospect.

You can even try to discover the pain points that put them off buying from you in the first place and remove these, whether by offering free postage, a discount, or some other incentive to trial your product rather than a competitor’s.

3. Encourage Customer Reviews.

Your online business is likely already using AI and analytics tools to better understand its target audience. But, while technology has brought us a long way, who better to ask for feedback than your existing customers? They know, better than anyone, why they chose your product or service.

You should use welcome emails, website surveys, post-purchase communications, and so on to glean as much insight into customer behavior as possible. This way, you’ll be able to see which parts of your customer acquisition strategy are working and which of them aren’t.

4. Deploy a Chatbot for Lead Generation.

When it comes to moving customers down the sales funnel, a deft and subtle hand is needed. For some businesses, live sales agents might be required as part of the sales cycle, but for many ecommerce businesses, the level of support necessary can be greatly reduced by the use of chatbots.

It’s important to use chatbots as part of a seamless customer experience, but you must make sure you avoid these six common ecommerce mistakes. So long as you do, you’ll be able to provide around-the-clock customer support at a significantly lower cost than if you were using human agents.

5. Display Social Proof.

When marketing to your target audience, it’s important to provide proof of your product’s utility and value in a real-world setting. Luckily, social media has made it easier than ever for businesses to engage with their customers through an improved sales strategy.

Use platforms that let you track your mentions and reply to every potential customer on that social media platform. Encourage your existing customers to share your products online too. In this way, you can acquire new customers with sales costs approaching zero.

6. Employ Marketing Automation.

There are so many SaaS tools available to ecommerce businesses today, so make use of marketing automation to improve your lead generation and conversion rates. According to HubSpot, 20 percent of marketers are using automated email marketing campaigns, and 68 percent of businesses use some form of marketing automation.

Automation tools can help to build a highly customized and meaningful experience for potential customers. They can also streamline things like email drip campaigns and retargeted ads, so your team members can spend their time acquiring new customers more effectively.

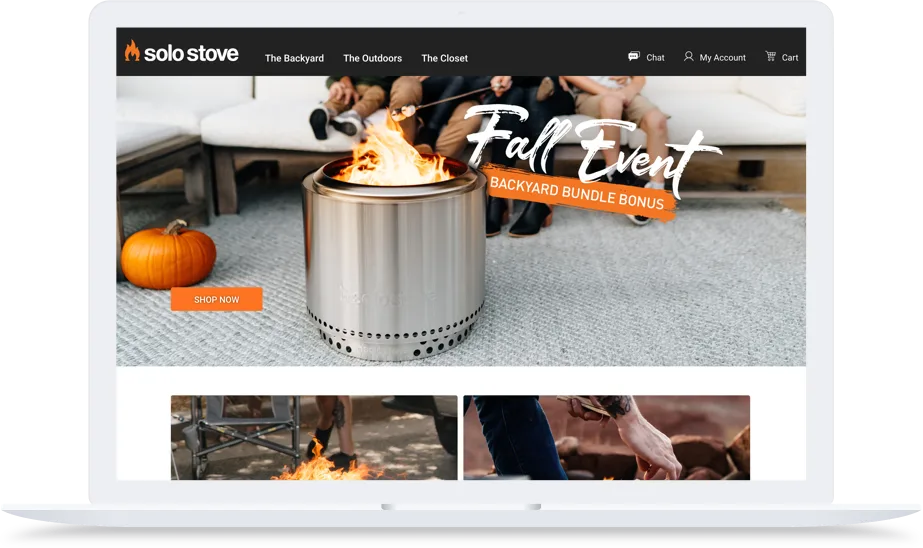

Image source: BigCommerce

An example of this in action is Solo Stove. When two brothers combined their love of the outdoors to start the company, they never imagined how successful their business would be, but they were able to level up by switching to the BigCommerce platform. They ended up spending 60 percent less on marketing, but through the use of things like email automation, increased their conversions by over 50 percent.

7. Optimize Google Ad Campaigns.

Do your due diligence when it comes to implementing your Google Ad campaigns too. Your business is paying a pretty penny to market to your intended audience, so it’s best to maximize your investment.

Your ecommerce business tracks its stock with an inventory management system using barcodes. Follow the same route when it comes to tracking customer interaction with your ad spending. Track all of your ad conversion metrics, whether clicks, signups, or buy nows.

You can use Google’s search query reports to make sure your targeted keywords match with your audience segments and adjust accordingly to improve your keyword quality score. Don’t underestimate the importance of your ad copy either.

Factoring in Customer LTV

Once you have a solid grasp on your CAC, you may feel ready to take on the world, but it doesn’t end there. On its own, CAC is yet another number. It doesn’t paint a clear picture of business health when used in isolation. The real cost of customer acquisition must be given some sort of context by looking at related customer spending.

Customer lifetime value, also known as CLV, CLTV, or LTV, is the total worth of a customer to a business for the duration of their relationship with your products and services. Things like customer retention and churn have a huge effect on LTV. This is a valuable and distinct business metric from your net promoter score (NPS) and customer satisfaction (CSAT).

The higher your LTV, the more valuable your business is considered. It costs much more to acquire new customers than it does to keep existing ones. So, a higher LTV means your business earns more for every dollar it spends acquiring new customers.

Just the same as with optimizing your acquisition costs, your business can look to maximize its LTV. And, in the world of ecommerce, personalization is the best way to stand out from the crowd.

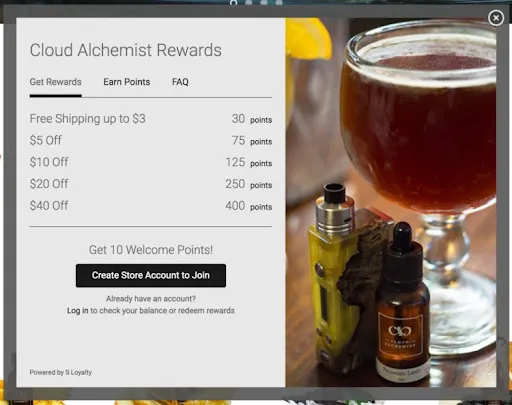

Image source: BigCommmerce

The Cloud Alchemist is a boutique liquid-vapor brand based in Seattle, and it provides a prime example of this. When the company decided to focus on increasing the lifetime value of its existing customers, it used a marketing strategy based on personalization. This included personalized emails, handwritten thank-you notes, and a customer loyalty program.

The best way for you to increase LTV will depend on many factors and will vary between industries. However, this metric should always be measured against CAC to optimize your sales and marketing efforts.

How to Calculate LTV

The lifetime value of a customer does not necessarily mean the amount they will contribute to your company in their lifetime. Instead, LTV is the total amount a customer will spend on your products during their relationship with your brand. Ideally, once you acquire a new customer, your business will retain them for the rest of their lives.

Depending on what products or services your business offers, this may include monthly purchases or be infrequent but large purchases throughout a customer’s lifetime. For any company, the value of repeat business is nigh-on priceless.

To calculate LTV, you should use this formula:

LTV = (average purchase value x average number of purchases) x (average customer lifespan).

Looking at this formula, it’s clear there are three main methods for increasing LTV.

How to Increase LTV

1. Increase the Average Purchase Value.

In ecommerce, this is also referred to as the average order value (AOV). Companies can adjust their pricing, the shopping experience, or widen their ranges of products and services to increase the AOV.

Take a company like LARQ. They offer a niche product range consisting of self-cleaning, plastic-free, and reusable water bottles. LARQ took advantage of the BigCommerce platform to gain more control over the customer journey through checkout, including an expansion to international markets with multilingual site support.

In just one year, they saw a resultant increase in AOV of 15 percent!

2. Increase the Average Number of Purchases.

How often a customer makes a purchase will depend heavily on your business model. A SaaS company can expect monthly or annual subscriptions from customers, with averages in years or longer. Other products, like shoes or a mountain bike, may have a certain lifecycle due to normal wear and tear.

Products that are built to last will require less frequent maintenance or replacement. Businesses should always consider this when pricing their products.

3. Increase the Average Customer Lifespan.

The average lifespan of a customer’s relationship with a brand is an area where any company can look to make improvements. It all comes down to reducing churn and increasing customer loyalty.

This can range from improving products and services to delivering an exceptional personalized customer experience. With 75 percent of consumers being more likely to buy from a company that knows their name and purchase history, ecommerce businesses must engage with their customers.

The LTV: CAC Ratio

When looking at how much your business spends on acquisition, it’s important to compare those costs to the value you can expect customers to provide. Niche retail customers might, on average, make only occasional small purchases throughout their lifetime, whereas a company selling B2B, like DDP Medical Supply, can expect customers to spend tens of thousands per year.

Obviously, with such a wide disparity, each brand should consider marketing and ad spending completely differently. Each customer acquisition model will require different marketing tools and sales skills dependent on the individual business.

A niche retail store, for example, may only have a budget of $20 per new customer but acquire thousands of them per month. The medical supplier, on the other hand, may acquire a handful of new customers per year but can afford to spend hundreds or even thousands of dollars on each of them.

While both businesses operate based on totally different models, they’re likely to have one metric in common – the LTV: CAC ratio. In other words, each business will spend a similar proportion of its customer revenue on marketing campaigns to acquire new customers.

The LTV: CAC ratio of a business demonstrates its potential for success. If the CAC is too high, the company is operating at or near a loss and will soon be insolvent. A ratio close to 1:1 would indicate your business needs to change its ecommerce pricing structure. If the LTV is too high, on the other hand, the business is underinvesting and missing out on opportunities to increase its revenue.

If you have an LTV to CAC ratio of 7:1, it means that for every dollar you spend, your company gets seven dollars back in customer lifetime value. The benchmark for an optimal business model is a ratio of 3:1. That means you should spend around 33 percent of your average LTV on new customer acquisition to create a profitable business model.

Conclusion

In the fast-evolving and competitive world of ecommerce, there are a lot of areas for companies to get right. It’s true you have to spend money to make money, but there are diminishing returns out there. Businesses can’t just spend willy-nilly, expecting an infinitely increasing waterfall of new customers.

At some point, the dam will start to run dry. It’s best to have a steady stream of new acquisitions and resources to spend elsewhere. Businesses that get it right will maximize the return on investment.

When it comes to marketing and ad spend, the act of balancing is an art in itself. Businesses need to have accurate metrics like CAC and LTV that can be seamlessly updated, either periodically or in real-time.

Changes in the LTV: CAC ratio must be addressed quickly by decision-makers at the company. Therefore, ecommerce businesses like yours must use the right tools for accurate data tracking and predictive analytics and have the ability to make agile changes apace with the market.

There’s no time to waste. Optimize your customer acquisition spending today and infuse a new lifeline into your business!

Xiao is the Director of global demand generation at Brightpearl, a leading retail operations platform. She is passionate about setting up innovative strategies to grow sales pipelines using data-driven decisions.