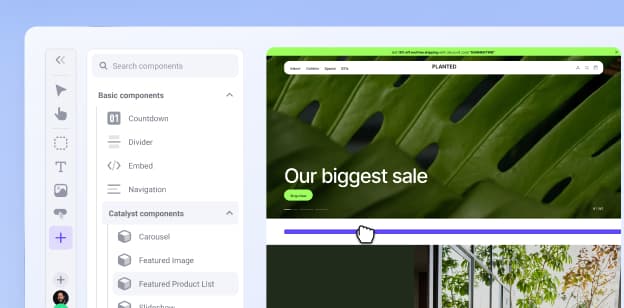

View the BigCommerce Product Tour

See how customizable, cost-effective and reliable BigCommerce is and why we built it that way.

What Small Ecommerce Sellers Need to Know About Economic Nexus

Not long ago, small ecommerce sellers were in a pretty sweet spot when it came to sales tax because they were generally required to collect sales tax only in states where they had a physical presence. But times have changed.

Today, out-of-state businesses can have an obligation to register in any state with an economic nexus law — which is every state with a sales tax.

Read on to learn more about economic nexus and how it can affect your business.

What is Economic Nexus?

“Nexus” refers to the connection between a state and a business that allows the state to tax the business. Economic nexus laws base a sales tax collection obligation on a company’s economic activity in a state, such as sales volume and/or number of transactions.

When businesses first started selling through the Internet, nexus had to be physical in nature; a state could require a business to register for sales tax only if the business had some sort of physical tie to the state.

Although many states wanted to tax remote sales (i.e., sales by a business with no physical presence in the state), they lacked the authority to do so.

That changed when the Supreme Court of the United States overturned the physical presence rule in South Dakota v. Wayfair, Inc. (June 21, 2018).

The case centered on a 2016 economic nexus law that imposed a sales tax obligation on any out-of-state seller who, in the previous or current calendar year:

Had more than $100,000 in gross revenue from the sale of tangible personal property, electronically transferred property or services delivered into South Dakota; or

Made 200 or more separate sales of tangible personal property, electronically transferred property or services for delivery into South Dakota.

To the surprise of many, the Supreme Court ruled in favor of the state. It ruled nexus could be based solely on an out-of-state company’s virtual and economic ties to a state. Although physical presence still triggers sales tax nexus in every state with a sales tax, it’s no longer requisite.

Wayfair Changed Everything

The Wayfair decision represented a sea change for states — and by extension businesses. Although typically slow to embrace a change of this magnitude, states took the decision and ran.

Less than two weeks after the gavel dropped, Hawaii, Maine and Vermont started taxing remote retailers under economic nexus laws they had waiting in the wings. Approximately 20 additional states were enforcing economic nexus before the year was out.

By the end of 2020, Florida and Missouri were the only two sales tax states without an economic nexus law; economic nexus had even been adopted by some jurisdictions in Alaska, which has no statewide sales tax but allows local governments to levy local sales tax. There’s no sales tax in Delaware, Montana, New Hampshire, or Oregon.

Florida enacted economic nexus in April 2021 and began requiring out-of-state sellers to collect and remit sales tax shortly thereafter, on July 1, 2021. The last state to fall was Missouri, which will begin enforcing economic nexus January 1, 2023. With one of the most complicated local sales and use tax regimes in the country, the Show-Me State needs time to prepare.

So, all states with sales tax now have an economic nexus law. However, not all economic nexus laws are alike.

What You Need to Know About Economic Nexus to Keep Yourself Out of Trouble

If you sell to consumers in different states, you need to understand the following:

Economic nexus thresholds vary from state to state.

Economic nexus laws can affect you if all your sales are exempt.

Economic nexus laws aren’t set in stone.

1. Economic nexus laws vary from state to state.

All economic nexus laws base a sales tax collection obligation on economic activity in the state. Beyond that, every state’s economic nexus law is unique.

Different dates. Effective dates range from July 1, 2018, to January 1, 2023. California began taxing remote sales April 1, 2019; Texas started on October 1, 2019. New York’s effective date is simply “immediately” after the Wayfair ruling, June 21, 2018.

Different thresholds and evaluation periods. Every state provides an exception for companies with little business in the state, but each state uses a different economic nexus threshold.

Following the lead of South Dakota, numerous states have a threshold of $100,000 in sales or 200 transactions, as do Washington, D.C., and the territory of Puerto Rico. If in a year you make less than $100,000 in sales or fewer than 200 transactions in those states, you likely won’t trigger economic nexus. Make more than $100,000 in sales or more than 200 transactions in a year and you probably will.

Several states, including Florida and Kansas, have a $100,000 sales threshold but no transaction threshold. Alabama’s threshold is $250,000 in sales. The threshold in both California and Texas is $500,000, while in New York it’s $500,000 in sales and 100 transactions.

When measuring your sales into a state, you need to consider that state’s evaluation period. Many states use the current or preceding calendar year, but Alabama counts sales from the previous calendar year only, while New York uses the previous four sales tax quarters, as defined by the state.

You also need to know which sales to count, for each state includes different types of sales in the threshold. When determining whether Florida’s threshold has been met, you should count only taxable sales of tangible personal property delivered physically into the state. Yet when calculating the threshold in Massachusetts, you should count both taxable and exempt sales of tangible personal property and services.

This state-by-state guide to economic nexus laws provides state-specific threshold details.

2. Economic nexus laws can affect you even all your sales are exempt.

Since many states include exempt sales of goods and/or services in their economic nexus thresholds, economic nexus can affect you even if you don’t make any taxable sales.

Approximately 40 states include exempt sales of tangible personal property in their economic nexus thresholds, and more than 25 states include exempt services. In some states, wholesale transactions are not included; in others, resales of property are.

Even if you won’t be collecting sales tax, you may be required to register for a sales tax permit, validate your sales with an exemption or resale certificate, and file returns. So, if you’ve ever thought that economic nexus can’t impact you, think again.

3. Economic nexus laws aren’t set in stone.

Making matters more complex is the fact that states can and do amend their economic nexus laws, like any other sales tax law. In fact, because taxing remote sales is relatively new, and because many states rushed to enact economic nexus, these laws have undergone a fair amount of change over the past three years.

For example, Colorado, Maine, North Dakota, Washington and Wisconsin eliminated their transaction thresholds after a time. Arizona’s sales threshold started at $200,000 in 2019, dropped to $150,000 in 2020 and settled at $100,000 from 2021 forward. New York’s threshold moved in the other direction: It started at $300,000 sales and 100 transactions before increasing to $500,000 sales and 100 transactions.

Washington added resales to its economic nexus threshold more than 18 months after the law first took effect. Connecticut added services to the threshold but eliminated a requirement that the out-of-state retailer regularly or systematically solicit sales in the state.

Several states have also expanded economic nexus to other taxes. For example, Washington has an economic nexus standard for business and occupation (B&O) tax, and Texas has one for franchise tax. In addition to sales tax, out-of-state sellers may be liable for certain fees in Arkansas, Indiana, North Carolina and other states.

One of the great benefits of ecommerce is that you can reach customers throughout the country and the world. One of the drawbacks is that you can develop economic nexus in any state where you have customers, meaning you may have to register with the tax department, collect tax on taxable sales, validate exempt sales, and file and remit sales and use tax returns on time.

The first step toward achieving compliance is learning about economic nexus. The second is determining where you’re most at risk of establishing it.

Avalara’s free nexus assessment can help.

Avalara AvaTax lets you instantly and accurately calculate US sales tax for your customers at checkout. Avalara uses hundreds of thousands of taxability rules and the latest tax jurisdiction boundaries to assign the right rates. So even if you sell products with special tax needs, you can be sure that you’re maintaining tax compliance and accurately charging your customers. Install the plugin here.