How to Navigate Amazon's 1P vs 3P Models: A Strategic Guide to Marketplace Success

Written by

Nicolette V. Beard

Amazon's marketplace has completely transformed how businesses sell online, forcing brands to make a crucial choice: become a first-party (1P) vendor or operate as a third-party (3P) seller. Each path offers distinct advantages for reaching customers and growing revenue.

Recent developments, including Amazon's systematic termination of smaller vendor accounts in late 2024, have accelerated the need for brands to understand these distinct pathways. This shift pushed many businesses to reevaluate their approach and understand which selling model works best for their goals. Brands now face pressure to master new technologies and use data effectively to stay competitive.

This comprehensive analysis empowers ecommerce brands by examining the critical differences between Amazon's selling models, exploring the market forces driving current transitions, and providing actionable frameworks to guide strategic decision-making in a data-driven marketplace.

Understanding Amazon's dual-selling architecture

Amazon's marketplace operates on two fundamental selling models that create distinctly different relationships between brands and the platform. In the 1P selling model, a brand acts as a first-party seller, essentially becoming a wholesale supplier to Amazon. The marketplace purchases products in bulk and assumes control over pricing, fulfilment and customer relationships.

In this arrangement, vendors operate through an invitation-only Vendor Central portal, essentially becoming suppliers to Amazon rather than direct sellers to consumers. Amazon handles all logistics, fulfilment, customer service and returns, effectively acting as a large-scale online retailer for the brand.

The third-party (3P) model positions brands as independent sellers on Amazon's marketplace, providing significantly more control over pricing, marketing, and brand presentation while simultaneously increasing operational responsibilities. These sellers utilise the Seller Central portal and maintain direct relationships with end customers, though they can leverage Amazon's infrastructure through services like Fulfilment by Amazon (FBA). The 3P model enables brands to maintain ownership of their products throughout the sales process, reducing their reliance on Amazon while preserving their brand identity.

Brands must strategically choose between these pathways to optimise their market presence and effectively sell new products.

We're serious about B2B.

BigCommerce B2B Edition gives you account management and quoting tools to help your sales team get more orders.

Key differences between 1P and 3P.

The fundamental distinction between these models extends beyond operational differences to encompass strategic business implications. Vendor Central access requires an invitation from Amazon based on their A9 Algorithm assessment, with decisions to accept or reject businesses resting solely with Amazon. This invite-only structure contrasts sharply with Seller Central's open registration process, making 3P selling accessible to companies of all sizes without Amazon's prior approval. The choice between these models significantly impacts cash flow, with 1P vendors typically paid within net 90 days compared to more favourable payment terms for 3P sellers.

Market dynamics and recent strategic shifts.

Amazon's recent strategic realignment has created significant disruption in the vendor landscape, particularly affecting vendors with annual sales under $5-10 million. This decisive action represents Amazon's ongoing efforts to optimise operations and concentrate on vendor relationships with larger, more strategic partners while encouraging smaller brands to adopt the self-service 3P model. Amazon encouraged terminated vendors to continue selling through Seller Central as independent sellers, highlighting the company's preference for pushing smaller brands toward the 3P model. This transition aligns with Amazon's broader strategy of reducing operational complexity while maintaining marketplace diversity through independent sellers.

Data-driven market analysis.

Statistical evidence reveals the dominance and growth trajectory of third-party selling on Amazon's platform. In the fourth quarter of 2024, third-party sellers accounted for 62% of paid units on the Amazon marketplace, demonstrating the significant market share commanded by independent sellers. This data underscores the potential for growth and success in the Amazon marketplace, inspiring confidence in ecommerce brands looking to expand their presence.

Amazon's annual revenue from third-party seller services reached approximately $140 billion in 2023, representing a nearly $23 billion increase from the previous year. These services encompass commissions (referral fees), fulfilment fees, shipping fees, and other third-party seller-related offerings, underscoring Amazon's financial incentive to support and expand its third-party marketplace while providing context for recent strategic decisions to streamline vendor relationships. The growth trajectory suggests that Amazon views third-party sellers as a critical component of its long-term marketplace strategy.

Understanding these models is only the first step — success requires implementing sophisticated optimisation strategies tailored to each approach.

Optimisation strategies for 1P and 3P sellers

Success in Amazon's ecosystem, regardless of the selling model, requires sophisticated technology infrastructure and data analytics capabilities. For 3P sellers, this technological foundation becomes even more critical given their increased responsibility for inventory management, pricing optimisation, and performance monitoring. Advanced analytics platforms enable sellers to track key performance indicators, including conversion rates, advertising cost of sale (ACoS), and inventory turnover rates that directly impact profitability and marketplace visibility.

Dynamic pricing.

Data-driven optimisation extends to pricing strategies, where dynamic pricing algorithms can respond to competitive changes, seasonal demand fluctuations, and inventory levels in real time. Successful Amazon sellers leverage automated repricing tools that monitor competitor pricing, maintain buy box eligibility, and optimise profit margins simultaneously. These systems integrate with inventory management platforms to prevent stockouts that can damage seller rankings and customer satisfaction metrics.

Advertising.

Advertising optimisation represents another critical technological component, particularly for 3P sellers who must compete for visibility without Amazon's organic promotional support. Advanced bid management systems utilise machine learning algorithms to optimise sponsored product campaigns, automatically adjusting bids based on conversion data, profit margins, and changes in the competitive landscape. Integration with broader marketing technology stacks enables cross-channel attribution analysis and optimisation of customer lifetime value.

Inventory.

Inventory forecasting and supply chain optimisation require sophisticated predictive analytics that account for Amazon's specific fulfilment requirements and seasonal demand patterns. Successful sellers implement demand planning systems that integrate historical sales data, external market indicators, and Amazon-specific metrics, such as velocity rankings and category trends, to inform their sales strategy. These systems enable proactive inventory management, minimising storage fees while ensuring adequate stock levels to meet customer demand.

While optimisation strategies provide the framework for success, the right technology platform can dramatically simplify implementation for 3P sellers.

BigCommerce: Empowering third-party Amazon sellers

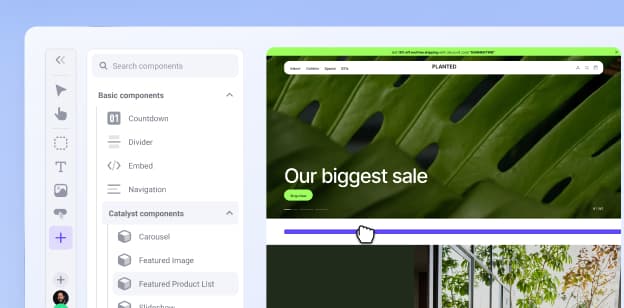

BigCommerce offers comprehensive native integrations with Amazon, streamlining marketplace selling for merchants who primarily focus on the third-party seller model. This connection eliminates much of the complexity typically associated with multi-channel commerce.

Unified catalogue and order management.

Merchants gain the ability to select products directly from their BigCommerce catalogue and list them seamlessly on Amazon. The platform automates the mapping of product attributes — including titles, descriptions, pricing, images, and variants — to Amazon's corresponding fields, thereby eliminating the need for manual intervention. Product information updates are automatically synced from BigCommerce to Amazon, ensuring consistency across both channels.

Order management becomes centralised through this integration, allowing merchants to handle Amazon sales alongside their website transactions within a single dashboard. Inventory synchronisation prevents the costly problem of overselling by immediately updating stock levels across both platforms when sales occur on either channel.

Whether merchants choose to use FBM (Fulfilment by Merchant) or work with third-party logistics providers, they can streamline their entire fulfilment workflow from a single location.

FBA support and Prime badge eligibility.

FBA support through the integration opens doors to Prime badge eligibility, one of Amazon's most valuable selling advantages. Merchants can manage their FBA inventory and listings directly from BigCommerce while gaining access to Amazon's premium shipping programme. Products enrolled in FBA automatically receive Prime eligibility, attracting Amazon's most dedicated customers who prioritise fast and free shipping. This Prime badge significantly increases both visibility and conversion rates, as Amazon handles all packing, delivery, customer service, and returns for these listings.

Scenarios for rapid marketplace expansion.

Several scenarios demonstrate the integration's power for rapid marketplace expansion. An established ecommerce brand with a thriving BigCommerce store can list its top 100 SKUs on Amazon and tap into its massive customer base quickly and efficiently using native integration, minimising operational overhead while evaluating this new sales channel. Similarly, a startup launching an innovative product can simultaneously list on Amazon through integration and enrol in FBA to achieve Prime eligibility from the launch day. This strategy enables smaller companies to compete effectively with larger competitors by providing the same trusted order fulfilment experience customers expect.

BigCommerce solutions for first-party vendors

While consumers typically consider Amazon a platform for purchasing products for personal use, Amazon Business is specifically designed to cater to business owners and enterprises, creating additional opportunities for B2B companies to sell products and grow their brand.

For brands operating under the 1P model (Vendor Central), where Amazon acts as the retailer, the challenges often lie in meeting Amazon's stringent data requirements for extensive and complex catalogues. This is where a sophisticated feed management solution like Feedonomics excels.

Automates catalogue management.

Feedonomics' integration with BigCommerce enables brands to easily list products on both Amazon Seller Central and Amazon Vendor Central platforms. Their system automates the creation and maintenance of product data specifically for Vendor Central through New Item Setup templates or API connections. Brands can provide raw product information from various sources, such as ERP systems, PIM platforms or ecommerce websites, and Feedonomics transforms this data to meet Amazon's exact formatting requirements.

API data efficiency.

Vendors have traditionally relied on complex spreadsheets, known as NIS templates, to submit product information; however, this method creates errors, consumes significant time, and becomes difficult to manage at scale. Feedonomics provides comprehensive feed management and optimisation services, leveraging APIs whenever possible and automating the spreadsheet generation process extensively. This API-driven approach syndicates product details to Amazon Vendor Central, reduces manual data entry and errors, speeds up product updates, and pulls error messages directly from Amazon into the Feedonomics platform — making them easy to find and resolve.

Large catalogue accuracy.

B2B companies typically manage vast catalogues containing thousands or millions of SKUs with complex technical specifications, multiple variations, and detailed compliance information. Feedonomics addresses this complexity through its sophisticated data transformation engine, which implements conditional logic, merges information from multiple sources, and ensures B2B-specific attributes are correctly mapped and updated on Vendor Central.

Beyond current optimisation tactics, forward-thinking sellers must prepare for the technological shifts that are reshaping ecommerce.

Looking ahead: How data-driven sellers can win tomorrow

Rapid technology advances, changing buyer habits, and new rules are reshaping how sellers optimise their businesses. Companies that want to stay ahead need flexible strategies that blend cutting-edge tools with smart compliance and quick pivots.

Artificial intelligence changes everything.

Machine learning now powers deeper customer insights, instant personalisation, demand forecasting and automated choices. These AI tools scour massive datasets to identify patterns, refine pricing, and enhance ad performance. Businesses utilising these capabilities experience improved conversion rates, more precise inventory planning, and stronger customer connections — all with reduced hands-on work.

Headless commerce breaks the mould.

Meanwhile, headless and composable architectures are transforming digital storefronts. By splitting the front end from the back end, brands deliver faster, more tailored experiences across every device and channel. This setup enables companies to plug in best-in-class tools for search, payments, and analytics without major overhauls. Organisations that adopt this modular approach gain speed and growth potential, enabling them to adapt to emerging new channels and technologies.

Privacy rules get tougher.

At the same time, data protection laws are becoming increasingly complex. Regulations such as GDPR, CCPA, and other global frameworks require greater transparency and customer control over personal data. With cookies disappearing and privacy expectations rising, sellers must shift toward first-party data tactics — email capture, loyalty programmes, and permission-based outreach. Building compliance into tech stacks means secure storage, clear policies, and consent management across all touchpoints.

Marketplace algorithms keep shifting.

Platforms like Amazon, Walmart, and Target constantly update their algorithms, ad structures, and seller support systems. These changes can shake up visibility, profit margins, and performance tracking. Staying competitive requires close monitoring of platform updates, diversification across channels, and avoiding dependence on any single marketplace.

Building agile infrastructure.

Investing in flexible data infrastructure — real-time dashboards, API connections, and cloud-based systems — helps sellers pivot quickly when the game changes.

Future-ready businesses need technology stacks that support headless commerce, API-driven data flows, and rapid integration of emerging tools. Solutions like BigCommerce Catalyst, Shopify Hydrogen, and Adobe Commerce enable brands to build custom tech ecosystems that grow with their business.

Connected teams create winning outcomes.

Success in this changing landscape depends on cross-functional collaboration. Data optimisation now touches marketing, IT, sales, operations, compliance, and customer service. Teams must break down silos, share discoveries, and act on information quickly. Cross-departmental alignment drives faster decisions, smoother customer experiences, and stronger operations, while continuous learning through industry conferences, ecommerce publications, and training programmes keeps skills and strategies current with market needs.

Ebook: B2B Digital Maturity Guide

Discover your maturity level as a B2B storefront and learn how you can improve.

The final word

Amazon's vendor landscape is constantly shifting, forcing businesses to rethink their approach. Terminations from Amazon have caught many brands off guard, yet these changes open doors for companies ready to take charge of their destiny.

The dominance of third-party sellers, who now control the majority of Amazon's marketplace, isn't accidental — it reflects where the platform places its bets. This shift demonstrates that independent merchants drive Amazon's growth engine, providing brands with more control over pricing, inventory, and customer relationships.

BigCommerce provides merchants with a streamlined path forward through its built-in Amazon connection and Amazon FBA integration, enabling Prime eligibility. For complex operations, Feedonomics provides automated data feeds that prevent costly mistakes, particularly valuable for B2B companies with technical specifications.

Both solutions achieve the same goal: reduced busy work, improved data quality, and enhanced performance on Amazon. Tomorrow's winning sellers will embrace emerging technologies, build adaptable systems, respect privacy, and encourage teamwork.

Companies that take a forward-thinking, data-focused, and collaborative approach will thrive in the next chapter of ecommerce. The question isn't whether change will come — it's whether you'll be ready when it arrives.

FAQs about Amazon 1P vs 3P

The decision ultimately depends on your business priorities, resources, and long-term goals. Many successful Amazon businesses eventually use a hybrid approach, but starting with 3P gives you the most flexibility and control as you develop your Amazon strategy. Here's why:

You can begin immediately without waiting for an invitation.

You maintain control while learning Amazon's ecosystem.

You can always transition to 1P if Amazon extends an invitation later.

It provides better profit potential in most cases.

First-party sellers (1P) are Amazon's direct retail relationships, where Amazon purchases products wholesale from manufacturers or distributors and then sells them directly to consumers. Conversely, the Amazon 3P model positions brands as independent sellers utilising Amazon's marketplace platform. These Amazon 3P sellers utilise the Seller Central account, enabling them to maintain greater control over product pricing, marketing, and brand presentation.

The key distinction is ownership and control: 1P involves Amazon buying and reselling products as a retailer, while 3P involves independent sellers using Amazon as a marketplace platform.

1P sellers face data scarcity and dependence on Amazon, while 3P sellers deal with data complexity and analysis challenges. Both must invest in the right tools and skills to turn Amazon data into actionable insights.

1P (first-party) seller challenges:

Limited data access: Amazon controls customer data, providing vendors with minimal insights.

Data delays: Reporting can be delayed or lack granularity, making it difficult to respond quickly.

Retail analytics costs: Advanced tools like Amazon Retail Analytics (ARA) Premium come at a cost.

Dependence on Amazon: While this model offers sellers the potential for higher sales volumes, businesses and entrepreneurs have limited control over pricing and promotions, thereby reducing the strategic planning value.

3P (third-party) seller challenges:

Data overload: More data is available, but it is often difficult to organise and analyse effectively

Tool complexity: Amazon's analytics tools require time and expertise to interpret properly

Inconsistent metrics: Data across different reports may not always align (e.g., FBA reports, keyword insights), creating confusion.

Competitive visibility: Limited insights into competitors' performance

Yes. Here are Amazon-specific recommendations:

Comprehensive Amazon analytics suites:

Helium 10: Designed for programmatic Amazon business management with tools for product research, keyword research, listing optimisation, and comprehensive reporting.

Jungle Scout: Offers real-time analytics, advanced financial tracking, AI-driven tools, and profit overview capabilities trusted by over one million sellers.

SellerApp: ML-powered algorithms providing actionable insights, featuring the unique Opportunity Score for product analysis.

DataHawk: Amazon analytics and optimisation software to increase sales and optimise margins.

Specialised Amazon tools:

Amazon Brand Analytics: A free foundational tool for sellers with a brand registry.

Data Dive: Precise keyword and ranking analytics with Rank Radar and heatmaps.

Perpetua: Amazon advertising optimisation for all ad types.

Feedonomics: Marketplace performance optimisation and Amazon product listing management.

Technology plays a crucial role in optimising ecommerce operations for both 1P and 3P Amazon sellers. The key is selecting technologies that align with your specific business model, growth stage, and operational challenges.

Start with core tools:

Inventory management system

Basic repricing tool (for 3P)

PPC management platform

Analytics dashboard

Scale gradually:

Add more sophisticated tools as your business grows

Invest in automation as manual processes become bottlenecks

Consider custom integrations for unique business requirements

Technology ROI considerations:

Calculate time savings from automation

Measure improvement in key metrics (conversion rates, ACOS, profit margins)

Factor in reduced errors and compliance risks

Consider competitive advantages gained

To prepare for future trends, sellers should focus on adaptability, data proficiency, and customer-centric strategies. Automation tools can handle pricing, inventory tracking, and ad campaigns, while AI analyses customer behaviour to predict future purchase orders. Building sales channels beyond Amazon provides more control, while voice search optimisation and sustainable practises meet evolving customer expectations.

Customer data becomes your secret weapon when collected through email lists and loyalty programmes. Analytics tools help spot trends before competitors do, while continuous learning through industry resources keeps you ahead of platform changes, privacy regulations, and emerging technologies like augmented reality. Success comes to those who adapt quickly while never losing sight of what customers value.

We're serious about B2B.

BigCommerce B2B Edition gives you account management and quoting tools to help your sales team get more orders.