by

One of the foundational aspects of business success is having a good pricing strategy, which directly impacts profitability, competitiveness and customer retention.

A well-designed pricing strategy can help business-to-business (B2B) companies maximize their revenue, increase market share and differentiate themselves from competitors.

B2B purchases are complex, involving multiple stakeholders, an extended sales cycle and high-value contracts. According to Marketing Chart, 63% of B2B buying committees consist of at least three decision-makers.

By accurately pricing their products, businesses can cover their costs while maintaining profit margins and offering attractive pricing to customers.

Where do you start? What should you look for? Here’s a complete guide to what pricing models are available and how they can best serve your business so you can build a better pricing strategy that will help you — no matter the customer, product or market.

Different B2B Pricing Models to Consider

The right product pricing model for your business depends on your industry, cost structure and customer base.

Competition-based pricing.

One of the most common pricing models in B2B, competition-based pricing involves analyzing competitor pricing as a baseline and setting prices slightly lower or higher depending on factors such as product quality, target market and B2B marketing strategy.

Competitor-based pricing is commonly used in saturated markets with homogenized products, such as consumer goods, retail and telecommunications.

Value-based pricing.

In industries with a high degree of differentiation and demand — eg: luxury goods, software and consulting services — businesses will set prices according to the product’s perceived value.

A value-based pricing strategy captures the maximum amount a customer is willing to pay, rather than focusing on the cost of production or competitor pricing. This is common for innovative or premium products.

Dynamic pricing.

Dynamic prices change in real-time and are set by algorithms that analyze data on market demand, competitor prices and other factors, such as the cost of raw materials.

For example, a hotel might raise its prices during peak travel season and lower them during the off-season. Or the price of a custom shed might fluctuate based on the cost of lumber.

Cost-plus pricing.

After calculating the cost of production, businesses add a markup — typically expressed as a percentage of production costs — to achieve a desired profit margin.

These include direct costs (such as labor, materials, and equipment) and indirect costs (overhead expenses including rent, utilities and payroll). Cost-plus pricing is often used in industries with a high degree of standardization and competition, such as manufacturing or construction.

A New Approach for New Expectations

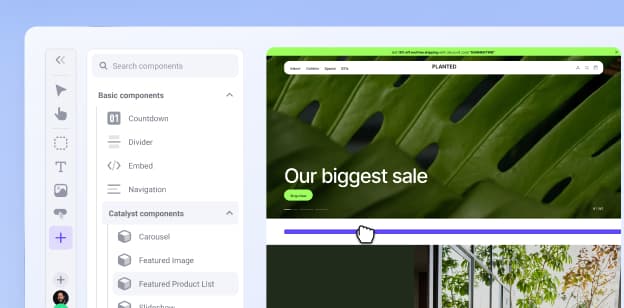

BigCommerce’s B2B ecommerce platform enables you with powerful features to readily meet — and exceed — your buyers’ expectations.

Various Pricing Structures to Choose From

Offering flexible pricing structures and custom quote generation lets you cater to customer needs while accommodating different budgets.

Flat-rate pricing.

Businesses may charge a fixed price regardless of usage or purchase volume. This is the de facto pricing model for industries with predictable production costs, such as software or consulting services.

Flat-rate pricing eliminates the need for complex calculations or negotiations, simplifying the purchase for the business and the customer.

Here are examples of businesses that offer flat-rate pricing:

SaaS (Software-as-a-Service) businesses: Many SaaS companies charge a flat monthly or annual fee for their software products, regardless of the number of users or volume of data used.

Web hosting providers: Customers pay a fixed amount regardless of website traffic or data use.

Consulting firms: Firms charge a flat fee for a specific project or deliverable, such as content marketing or IT consulting.

Usage-based pricing.

Also known as pay-as-you-go, usage-based pricing is commensurate with consumption. For example, utility companies charge based on electricity usage.

This pricing model is typically used by B2B businesses whose products are used on a recurring basis or require ongoing support, such as technical troubleshooting and after-sales care.

Here are examples of businesses that offer usage-based pricing:

Cloud computing providers: Companies like Amazon Web Services allow businesses to pay only for the computing resources they use.

Equipment rental companies: Companies charge according to the amount of time the equipment is used.

Ride-sharing services: Customers pay based on travel distance and trip duration.

Tiered pricing.

Tiered pricing offers different price points based on features, functionality and access. For example, the basic tier for project management software lets users create a limited number of projects, the standard tier provides advanced features like team collaboration and time tracking, while the premium tier includes custom reporting and advanced analytics. Tiered pricing offers upselling opportunities.

Some B2B companies include a “freemium” tier for lead generation purposes that lets new users access a limited version at no cost in the hope they’ll convert to paying customers.

Per-user pricing.

SaaS businesses often charge a per-user fee according to the number of licenses purchased.

Per-user pricing is based on the idea that the more users a business has, the more value it gains from the product or service. This lets businesses capture more value from enterprise customers while providing an affordable option for smaller businesses.

Best Practices for Developing a B2B Pricing Strategy

Pricing strategy is one of the most important business decisions you’ll ever make as it affects your profitability, reputation and competitiveness in the market. Here are some key considerations to account for:

Determine the value of your product.

While this might seem like a subjective assessment, you can take a scientific approach to determine the customer value of your product.

Here’s how to get started:

Identify your target market: Who are your customers and what problem do they need solved? What value do they get from your product? Consider factors like time saved, peace of mind or status and recognition. What is your target market’s budget?

Conduct market research: Determine how your product measures up to the competition. What features and benefits do you offer that others don’t? How much are customers willing to pay for similar products and what pricing strategies do your competitors use?

Calculate your costs: What are the costs of producing and delivering your product, and what margin is necessary to cover these costs and generate a profit?

Determine the perceived value: Find out how much customers are willing to pay based on your product’s perceived benefits. User interviews, focus groups and surveys can help.

Experiment with various pricing models.

A/B-test different pricing strategies and promotions to see how customers respond. A/B testing entails randomly assigning different pricing strategies to different groups of customers and then analyzing the results to see which pricing strategy performs best.

Make data-driven decisions.

B2B businesses can make data-driven decisions about pricing strategy by tracking sales and customer behavior.

Here are the key metrics to watch:

Customer acquisition cost (CAC): By tracking CAC, businesses can evaluate the cost-effectiveness of their pricing process and determine whether they are acquiring customers efficiently. This is calculated by dividing the total sales and marketing costs by the number of new customers acquired during a given time period.

Customer lifetime value (CLV): This metric measures the total revenue a customer will generate for a business over their lifetime. By calculating CLV, businesses can evaluate whether their pricing strategy generates sufficient revenue per customer.

Gross margin: Gross margin is the difference between revenue and the cost of goods sold, expressed as a percentage. This indicates the profitability of your pricing approach.

Churn rate: Churn measures the percentage of customers who stop doing business with you over a given time period. A high churn rate may indicate your prices are not competitive.

Price elasticity: By measuring how responsive your customers are to price changes, you can determine how much you can raise or lower prices before it impacts customer behavior.

Common B2B Pricing Mistakes to Avoid

Misguided pricing leads to lost sales, customer churn and diminished market share. Here are some common pricing mistakes to avoid:

Making pricing too complicated.

B2B businesses can overcomplicate pricing with confusing pricing structures, hidden fees and charges, or inconsistent pricing across channels, which breeds distrust.

While some businesses offer a mixture of pricing models to accommodate customer segmentations (eg: small business versus enterprise), you must reduce complexity for the customer by showing pertinent pricing information.

Custom quote generation is a great way to overcome confusion as customers only pay for what they need.

Relying exclusively on undercutting your competition.

Focusing exclusively on competitors in your pricing strategy can prove detrimental, kicking off a “race to the bottom” price war where businesses slash prices to undercut the competition, driving down profit margins.

Instead, focus on holistic pricing and introducing innovations that bring value to customers.

Neglecting competitor responses to your price.

B2B businesses can’t afford to disregard competitor pricing. Setting prices too high or low leads to lost sales and reduced profitability. Don’t be misled by overconfidence or a lack of market research. Continually monitor competitor pricing to gain an edge in the market.

Misaligning pricing and business goals.

Pricing is intimately linked with business goals because it determines a business’s profit margins and the volume of B2B sales required to break even. While low prices attract customers, the business might not generate sufficient revenue to recover costs.

In luxury markets, low pricing may undermine the business’ reputation.

Businesses should also consider customer needs in setting prices. Offering flexible pricing options like pay-as-you-go or fixed pricing lets customers purchase according to their budget and preferences.

Free B2B Masterclass

Want to grow B2B online sales faster? Start now by enrolling in our free B2B Masterclass.

The Final Word

Pricing strategy is critical to B2B business success because it can affect the bottom line.

Maintaining healthy profit margins is necessary for business survival and continued innovation, as excess profits can be invested back into the business to purchase new equipment, expand operations or develop new products.

Competitive pricing increases the business’s chances of capturing market share while making it easier for the business to acquire and retain customers.

Finally, pricing that is transparent and fair is a sustainable business strategy as it builds trust and sets the groundwork for long-term customer relationships.